Introduction to SIPs

If you’re new to the world of investing, you may have come across the term “SIP” or systematic investment plan. But what exactly are SIPs and how do they work? In this blog post, we’ll provide an informative and easy-to-understand introduction to SIPs, covering everything from their benefits to how to start one and common myths associated with them.

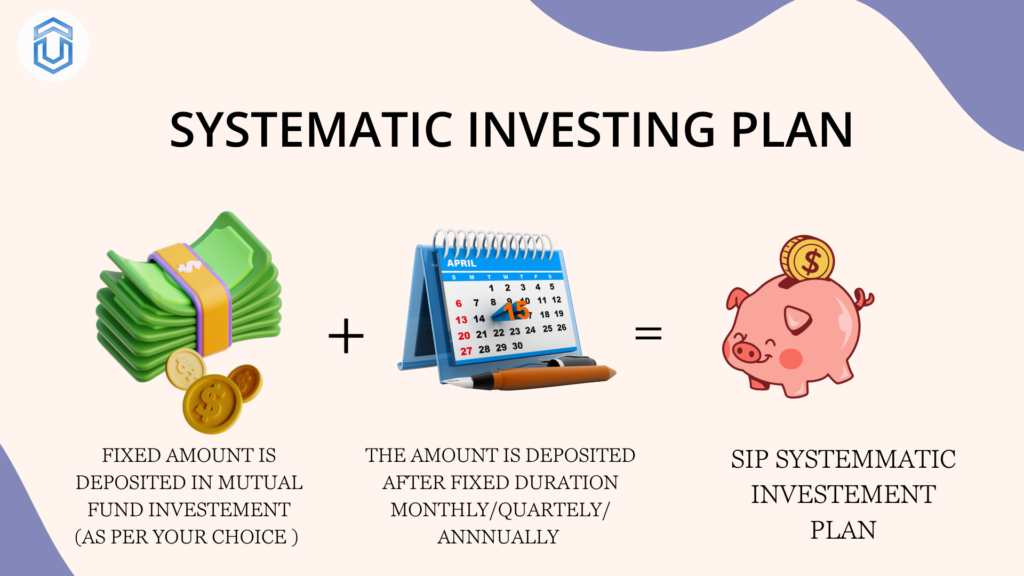

What Are Systematic Investment Plans (SIPs)?

SIPs are a method of investing in mutual funds where an investor contributes a fixed amount at regular intervals, typically monthly. This approach allows for disciplined and regular investing, regardless of market conditions. SIPs are a popular choice for individuals looking to build wealth over the long term in a systematic and hassle-free manner.

How Do SIPs Work?

When you invest in an SIP, your money is pooled with that of other investors and used to purchase units of a mutual fund. The number of units you receive is based on the fund’s net asset value (NAV) on the day of purchase. Over time, the value of your investment fluctuates based on the performance of the underlying securities held by the mutual fund.

Benefits of Investing Through SIPs

There are several benefits to investing through SIPs, including the ability to start with a small amount, rupee cost averaging, the power of compounding, and flexibility in investment frequency and amount. SIPs also help inculcate a disciplined savings habit and can mitigate the impact of market volatility on your investments.

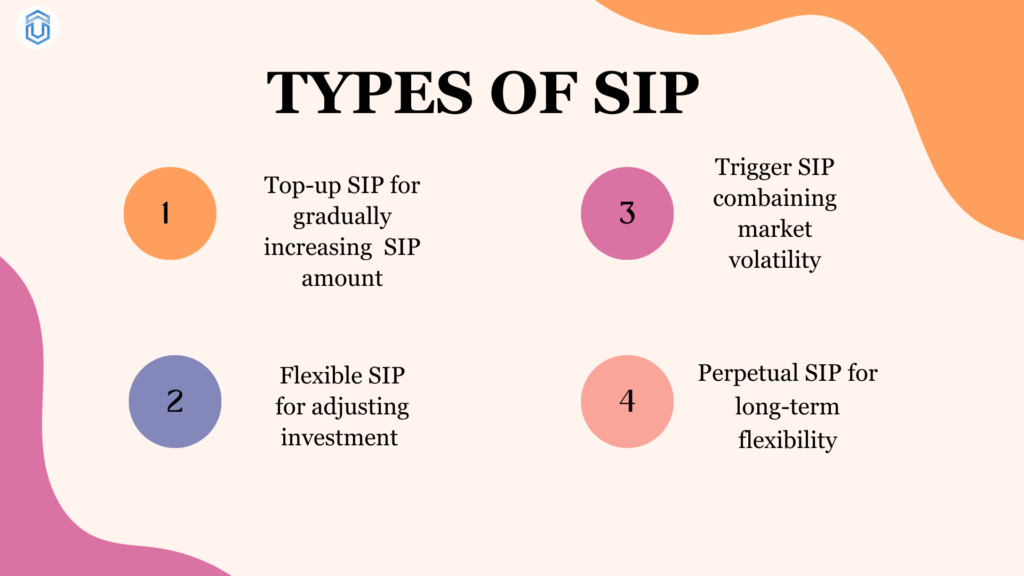

Types of SIPs

There are different types of SIPs available to cater to varying investment goals and risk profiles. Some common types include equity SIPs, debt SIPs, balanced SIPs, and tax-saving SIPs.

How to Start an SIP

Starting an SIP is a simple and straightforward process. You can approach a mutual fund company or a registered distributor to open an SIP account. You will need to provide some basic documentation and set up a bank mandate for the regular investment amount.

SIP vs. Lump-Sum Investment ,What is the difference

SIP (Systematic Investment Plan)

SIP involves investing a fixed amount regularly (monthly or quarterly) into a mutual fund.

Lump-Sum Investment

Lump-sum investing involves putting a large amount of money into a mutual fund all at once.

Key Differences

- Investment Timing: SIP spreads out investments over time, while lump-sum invests the entire amount at once.

- Market Timing: SIP reduces the impact of market volatility through regular investments, while lump-sum is more exposed to market timing risks.

- Flexibility: SIPs offer more flexibility and lower risk, while lump-sum requires careful consideration of market conditions.

Common Myths About SIPs

There are several myths surrounding SIPs, such as SIPs are only for small investors, SIPs guarantee returns, and SIPs are not suitable for long-term goals. It’s important to separate fact from fiction when considering SIPs as an investment option.

Tips for Maximizing SIP Returns

Systematic Investment Plans (SIPs) are a popular way to invest regularly in mutual funds, helping you build wealth over time. Here’s a brief guide to maximizing your SIP returns:

1. Start Early

The earlier you start investing, the more you benefit from the power of compounding. Even small, regular investments can grow significantly over time.

2. Invest Consistently

Stick to your SIP schedule regardless of market conditions. Consistency is key to averaging out market volatility and capitalizing on long-term growth.

3. Choose the Right Fund

Select mutual funds based on your investment goals and risk tolerance. Research different funds, considering their performance history, management, and fees.

4. Increase Contributions Gradually

As your income grows, consider increasing your SIP amount. Incremental increases can enhance your returns without straining your budget.

5. Stay Invested for the Long Term

SIPs work best with a long-term horizon. Avoid the temptation to withdraw funds during market dips and let your investments grow.

6. Review and Rebalance Periodically

Regularly review your SIP portfolio to ensure it aligns with your financial goals. Rebalance if needed to maintain an optimal asset mix.

7. Leverage Market Opportunities

Use market corrections or dips as buying opportunities to invest more. SIPs benefit from buying units at lower prices during market downturns.

8. Avoid Timing the Market

Focus on regular investments rather than trying to time the market. SIPs are designed to smooth out market fluctuations through consistent investing.

9. Stay Informed

Keep yourself updated on market trends and fund performance. Knowledge helps you make informed decisions and adjust your SIP strategy if necessary.

By following these tips, you can enhance your SIP returns and build a solid financial foundation for the fut

Conclusion: Are SIPs Right for You?

SIPs can be a suitable investment option for individuals looking to invest in a disciplined and systematic manner, with the potential for long-term wealth creation. However, it’s important to assess your investment goals, risk tolerance, and financial situation before committing to an SIP.

In conclusion, SIPs offer a convenient and effective way to invest in mutual funds, allowing for regular and disciplined investment with the potential for long-term capital appreciation. If you’re considering SIPs as an investment avenue, it’s advisable to seek professional advice and conduct thorough research to make an informed decision.