Options Trading has been one of the most attractive trading venues for many traders. It became so popular because of the speculative nature of the trading instrument. Because stock options trading are highly liquid and volatile, traders can make huge profits in a short period of time. But remember that since there are two sides to a coin, there are gains and losses in options trading. Your profits can be huge, but so can your losses. So, before starting to trade in the options market, it is always advisable to get the right information about options trading. There are plenty of Option Strategies available in the market. Analyze well before you take the trade using the tools.

This article provides a detailed explanation of the most important options trading terms.

What is Options Trading?

Options trading refers to the buying and selling of contracts that give the holder (buyer) the right (but not the obligation) to buy or sell the underlying asset at a predetermined price (called a strike price) before or on the expiration date of the contract. For giving the advantage to the options buyer, the options seller (writer) collects a premium from the buyer.

Example: Let’s say we have two people, Sam and Raghu. Sam and Raghu are planning to enter into an options contract.

Sam: Option Buyer

Sam believes that the stock price of Company X, currently trading at ₹ 450 per share, will rise significantly over the next few months. To profit from this potential increase without directly buying the stock, he decides to purchase a call option.

Type of Option: Call Option

Strike Price: ₹ 450

Premium Paid: ₹30 per share

Expiration Date: 3 months from now.

In this scenario,

Sam is the option buyer. He pays a total premium of ₹3000 (assuming each option contract is 100 shares). This premium gives Sam the right to buy Company X’s stock at ₹ 450 per share at any time before or on the expiration date.

Raghu: Option Seller

Raghu does not expect company X’s price to rise above ₹ 450 per share in the near term and decides to sell call options to generate income. Raghu is the option seller (writer). He receives a total premium of ₹3000. If Sam (the buyer) decides to exercise his option and buy the stock at ₹ 450 per share, Raghu is obligated to sell his shares to him at that price, regardless of the current market price.

Outcome:

Let us assume Company X’s stock price is below ₹ 450 at expiration, Sam may choose not to exercise the option, and Raghu keeps the premium as profit.

If the stock price rises above ₹ 450, Sam may exercise his option, buying the stock at ₹ 450 per share from Raghu, who is obligated to sell at that price.

Important terms in Options trading:

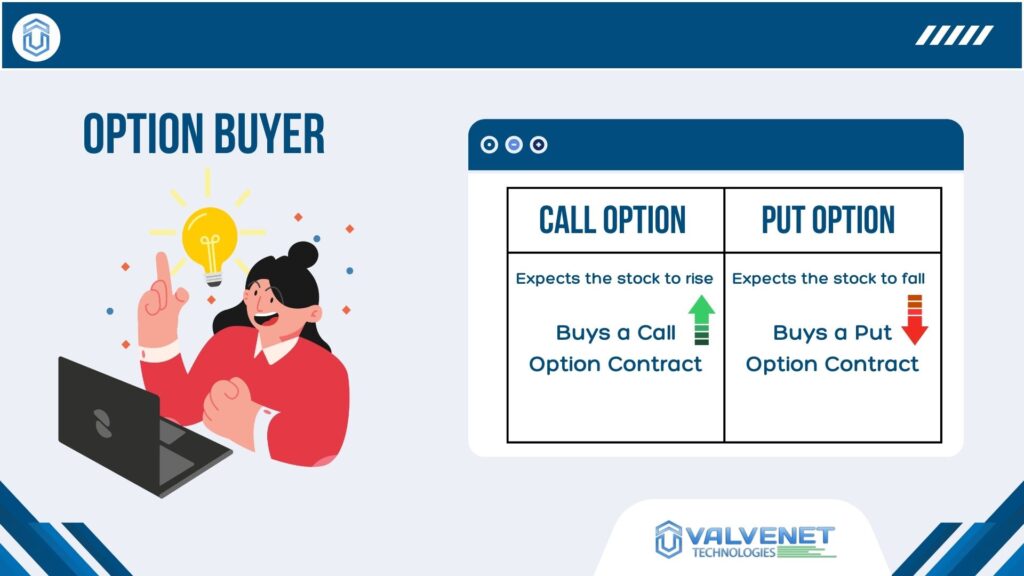

Options Buyer:

The buyer of an option has the right, but not the obligation, to buy or sell the underlying asset at a predetermined price on or before the contract expires. For this obligation, he pays a premium to the seller. Thus, his loss is limited to the premium paid. His profits are unlimited. If the buyer decides that the stock can go up, he buys a call option. If the same buyer decides that the stock may fall, he buys a put option. If the stock performs as he predicted, he will exercise his contract with the option seller. The seller of the option is obligated to sell the contract to the option buyer. If the stock does not perform well, the buyer of the option may not exercise his option. The option seller then pockets the premium he received from the option buyer.

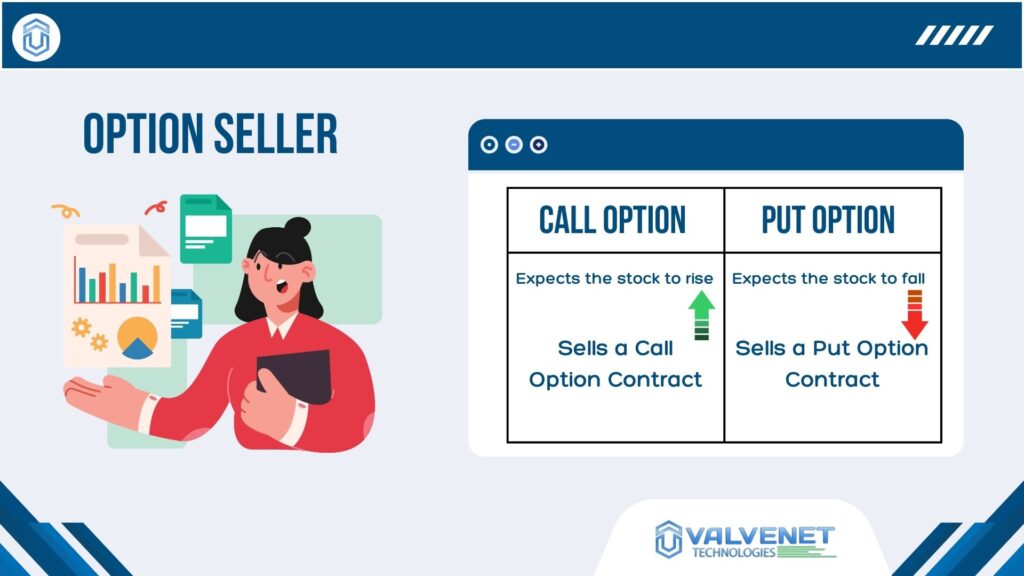

Options Seller:

An option seller, also called an option writer or grantor, is the person who sells the option to the buyer of the contract. In return for that, he receives a premium from the buyer of the contract. If the buyer of the option contract exercises the contract, the seller is obligated to sell the contract. Unlike the option buyer, who has the possibility of unlimited profit with limited risk, the option seller is in the opposite position. The option seller has a small profit (premium) and unlimited loss potential. Option seller is required to pay margins like futures positions. When selling call options, margin is initially calculated. This margin is then adjusted with the premium received.

Strike Price:

In an option contract, a contract is concluded between the buyer and the seller. The buyer of an option contract pays a premium for buying or selling the underlying asset at a certain price at or before the end of the contract. The specific price of the contract between the buyer and the seller is called the strike price. This can be called the exercise price. The exercise price of a call option is the price at which the buyer of the option can purchase the security. The price at which the security can be sold is the exercise price of a put option.

Market price may be higher or lower than the strike price. The strike price is an important factor in determining the option. In General, options with a strike price closer to the current market price of the underlying asset unusually have a higher premium. The strike price along with the expiration date determines the options. It can be in-the-money (ITM), at-the-money (ATM), or out-of-the-money (OTM), which affects the options probability.

Premium:

The premium of an option contract refers to the price paid by the buyer to the seller of the option contract. Since the premium is paid by the buyer, the seller gives the buyer the right to exercise the option contract. However, he is not obliged to exercise the options because he has taken the risk by paying the premium to the seller. The amount of the premium is the maximum loss that the buyer can face in the option contract. For the option seller, the premium is a limited profit that he can reserve if the option buyer remains in loss.

Expiration date:

The date and time when the option contract between the buyer and the seller expires is called the expiration date. For example, the expiry of the NSE weekly option contract is always set on Thursday. When the validity period expires, the contracts are declared invalid. If the option contract goes as expected by the buyer, the buyer executes the contract and the seller is forced to sell the contract on the expiration date. If the stock price does not go according to the buyer’s forecast, he cannot fulfill the contract and the seller will pocket the premium he received from the buyer as his profit.

Conclusion:

Options trading is popular among traders and investors who want to profit from market movements, manage risk or generate income. In addition to traditional stock trading, it offers flexibility and strategic options, but also requires good market knowledge, risk management and the special dynamics of option contracts. According to a recent SEBI report, nine out of ten traders lose more money while trading futures and options. So, before you plan to trade options, you should have a thorough understanding of the options market. Prepare your mind to manage your trading emotions and make consistent profits in options trading. Happy trading!

Comments