An option chain is a list of all available options contracts for a particular underlying asset, such as a stock or index. As we have discussed earlier, options provide a wide variety of contracts to trade. These contracts are listed as option chain along with in-depth information about their premium price, bid and ask price, volume, open interest and many more.

As the option chain have profound information, it helps the traders to identify the best strike price to trade, under a particular market condition.

Options are classified into two types. They are Call Option and Put option. Both the call option and put option contracts are displayed in the option chain side by side.

Traders are constantly drawn to options trading due to the diversity of contracts available for trading. Compared to futures and equity trading, which allow traders to trade stocks, options trading provides a large number of contracts for a single stock with multiple expirations.

As a result, options trading has grown in popularity among traders.

Option Chain with an example:

The options chain can be described as a list of all option contracts. It comes in two sections: call and put. Option chain is also known as the Option Matrix.

The option matrix allows numerous competent traders to easily see the direction of price fluctuations. Users can also utilize Option Matrix to examine and discover points where liquidity is low or high.

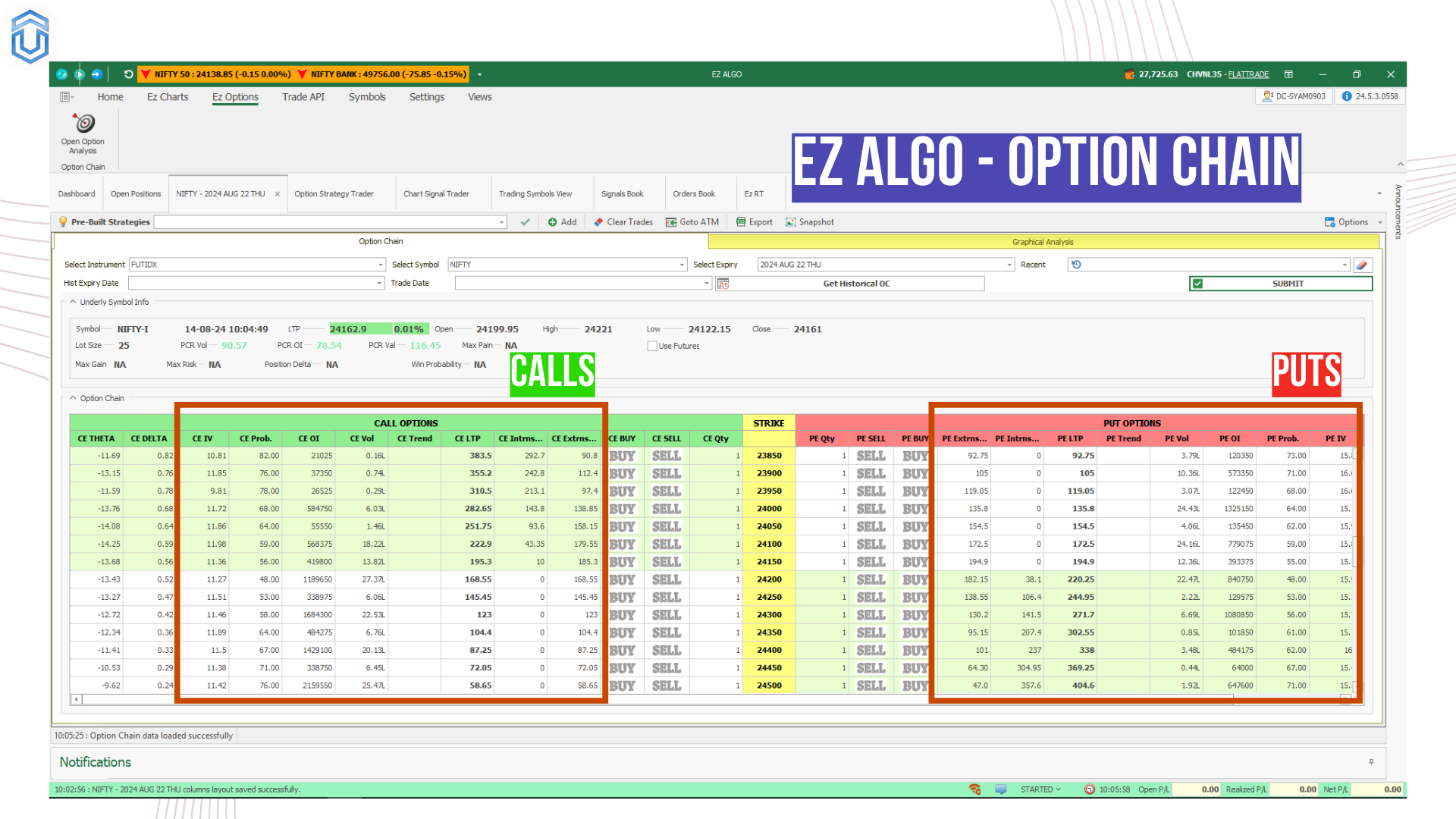

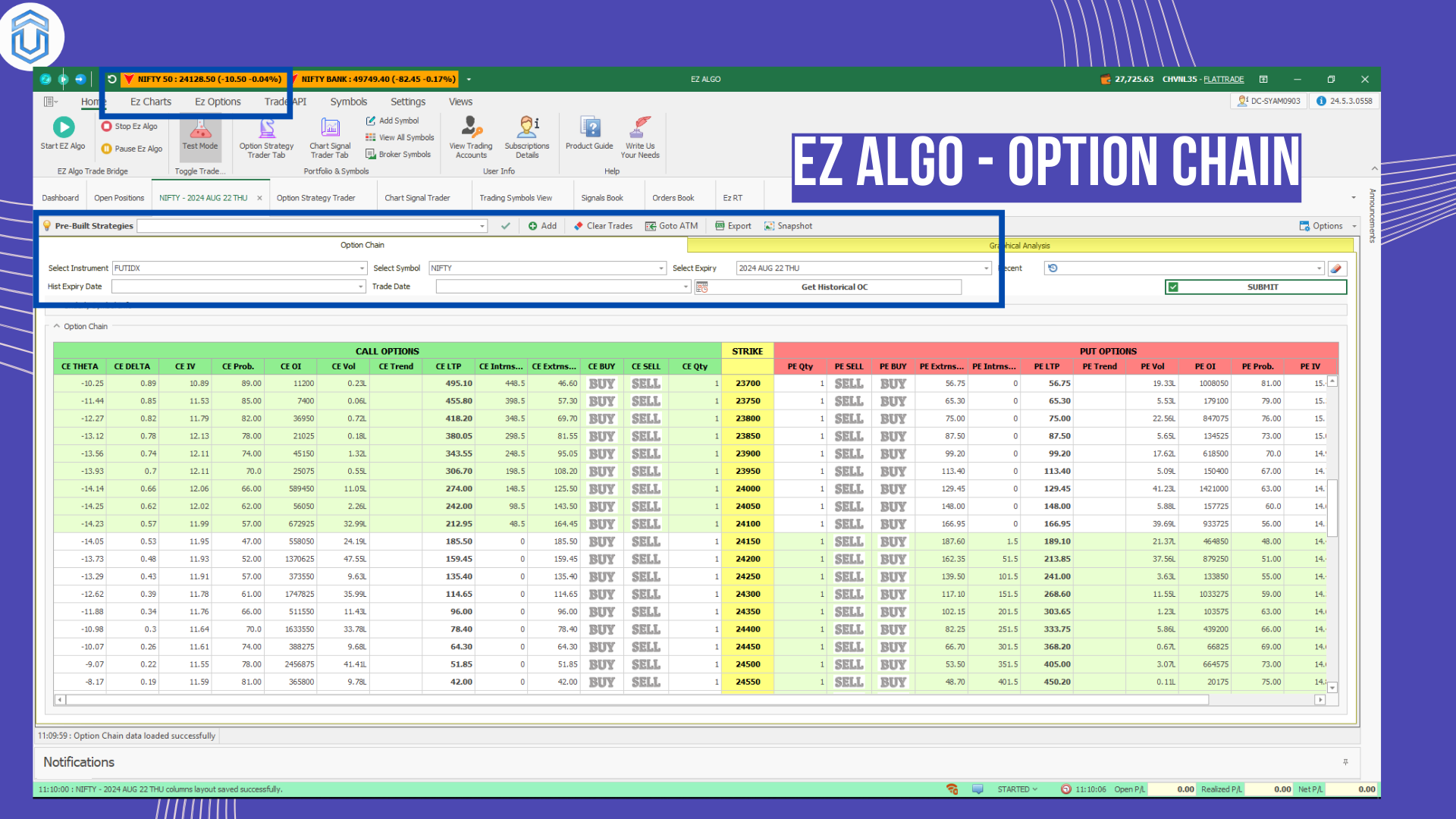

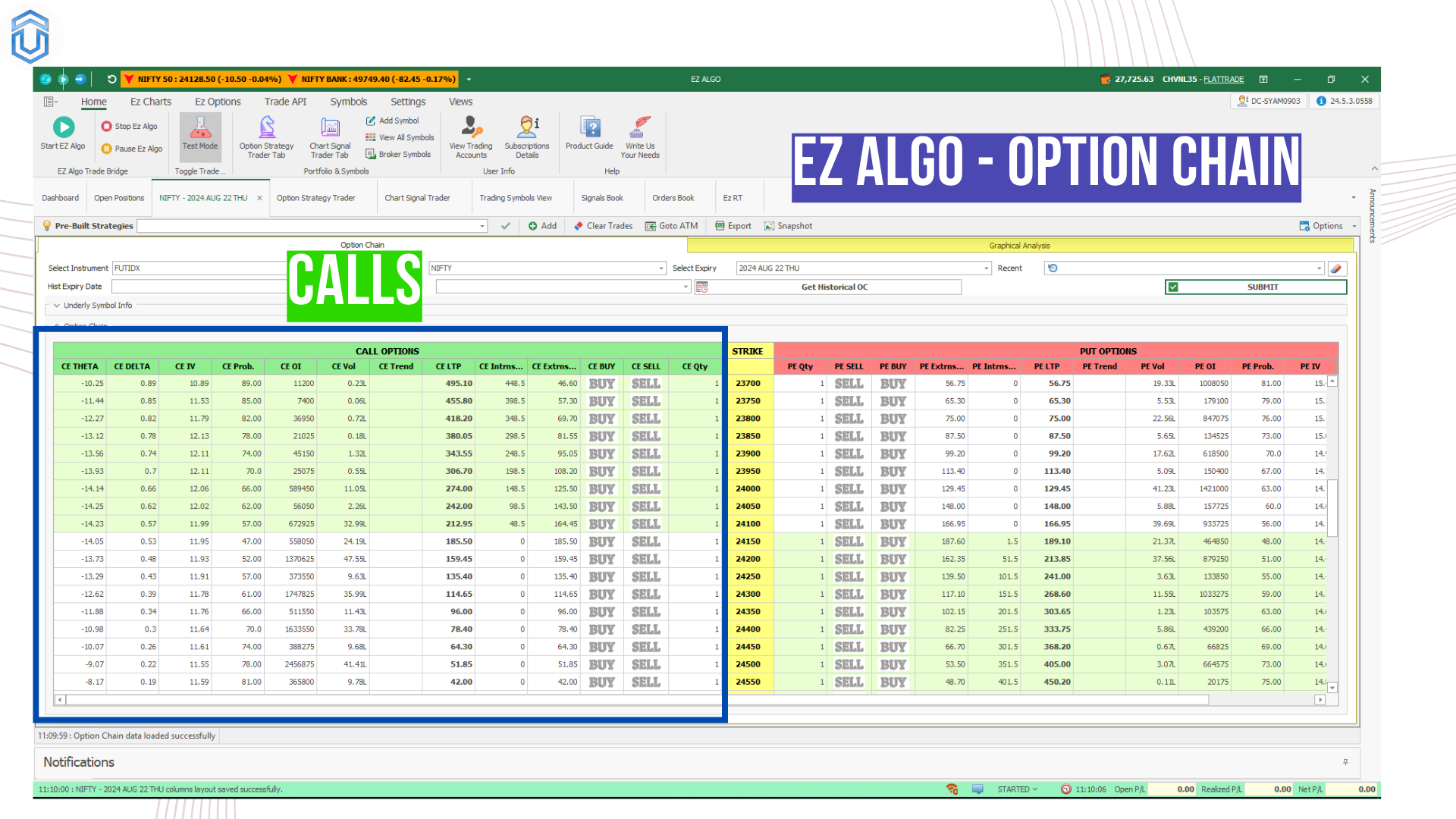

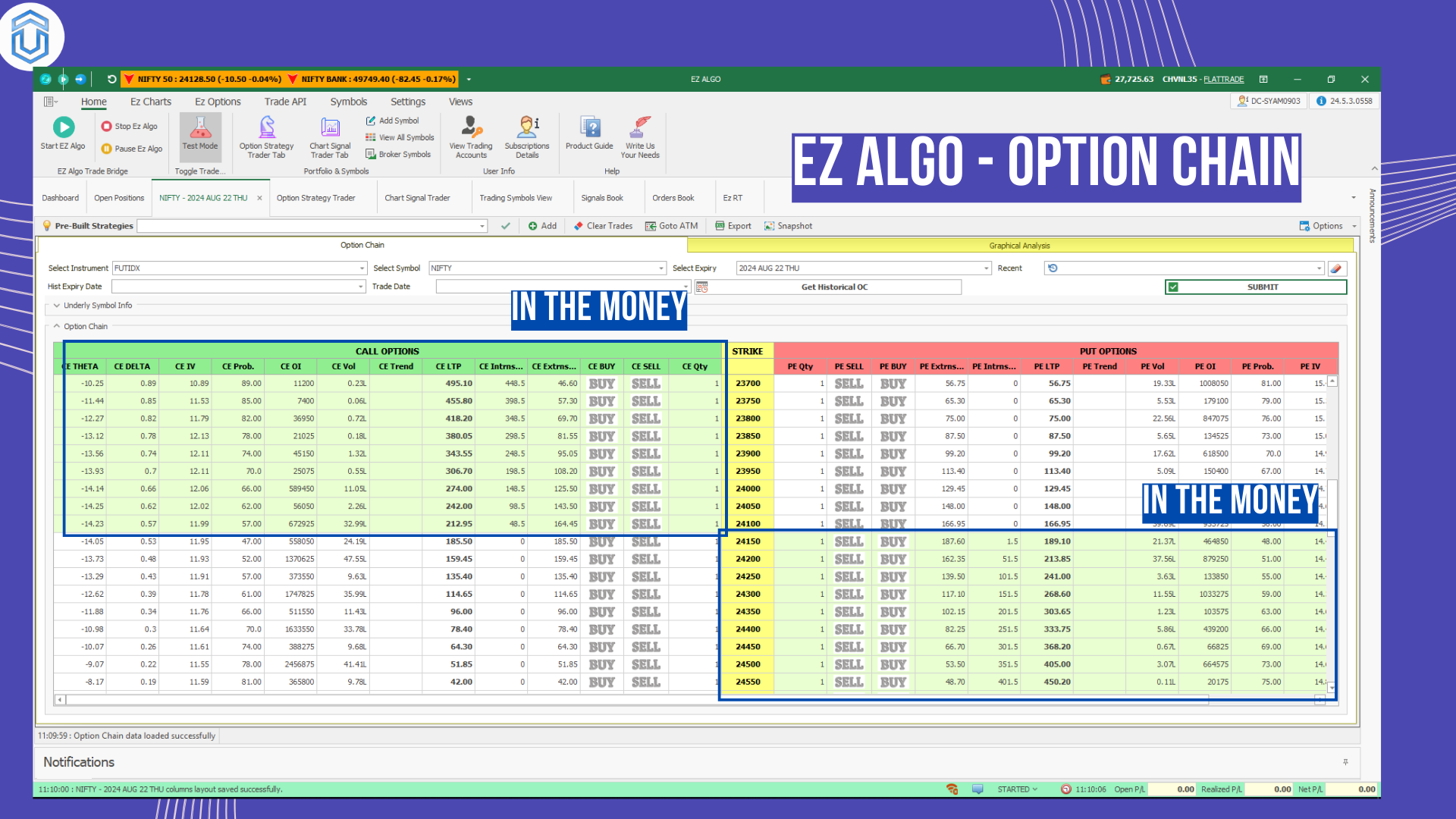

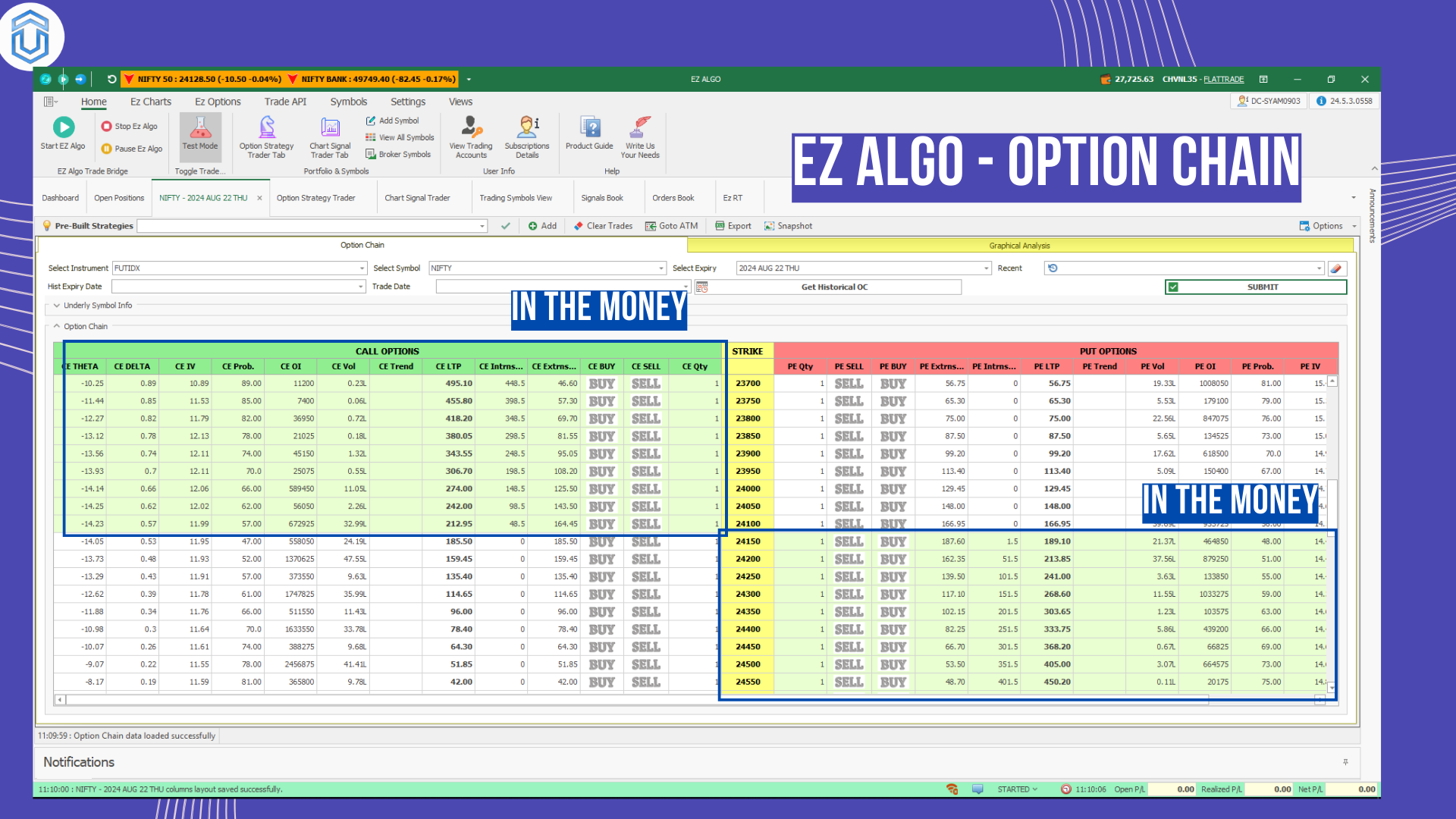

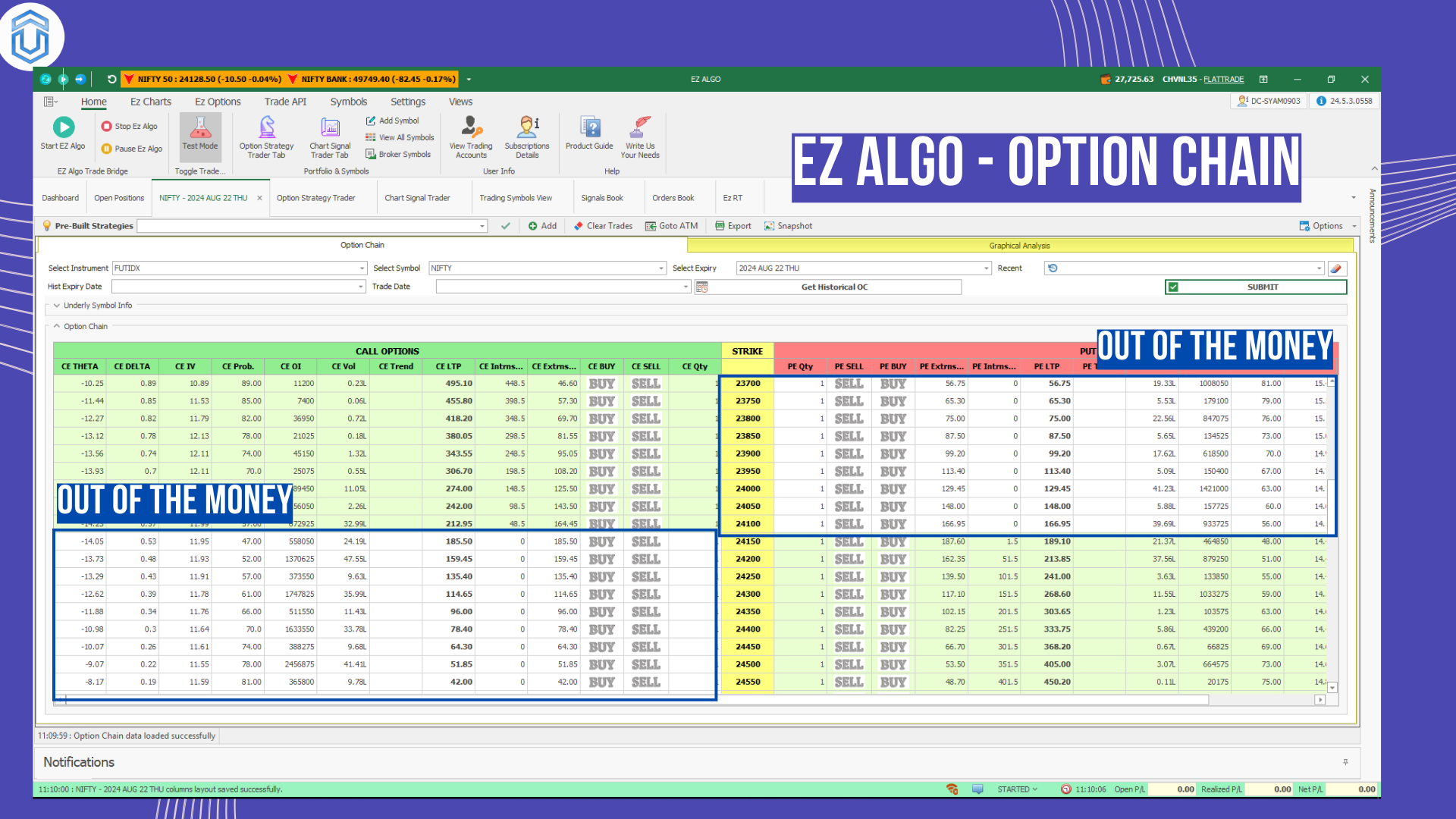

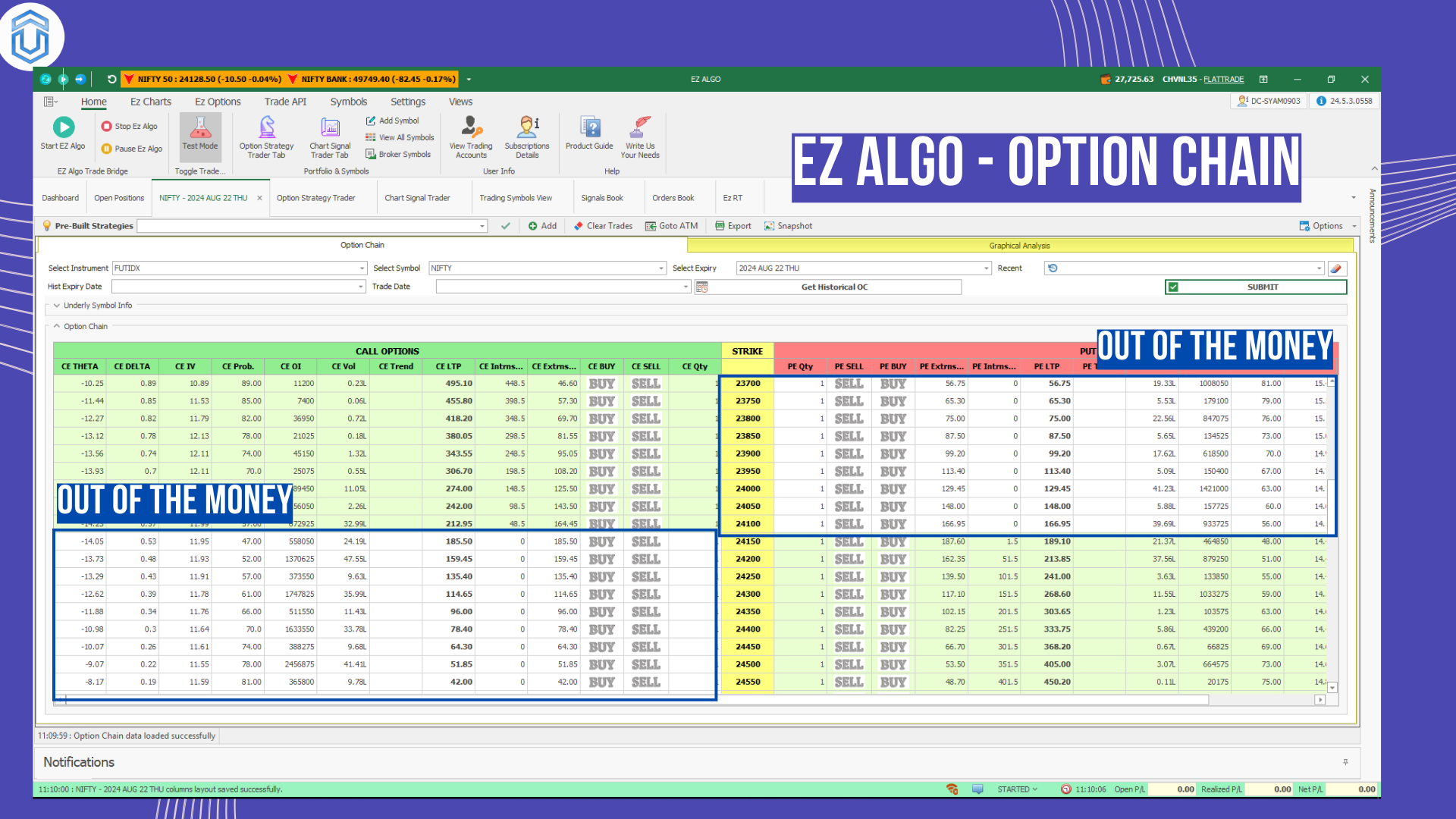

Look at the below chart of Option chain in our EZOption Chain platform. Here we have loaded Nifty Index option chain. The selected expiry is August 22nd August, 2024. All the details have been highlighted in blue rectangle. The underlying stock is Nifty spot.

The nifty spot price is ₹ 24,128.50.

In the left side of the option chain window is the call option and the right side is the put option. In the middle of the option chain window we can see the strike prices. Option chain includes all important data points along with the strike price. They are volume, Implied volatility, Option Greeks (Theta and Delta) values, Intrinsic and Extrinsic values.

Option Chain key components:

Option chain consists of various key components. The most important key components in option chain are

- Call Option

- Put Option

- Strike price

- At-the-money

- In-the-money

- Out-of-the-money

- Intrinsic value

- Extrinsic value

- Open Interest and Volume

- Options Greeks

Call Option:

In the option chain window, the left side represents the Call Options. Call Options are market with blue rectangle.

A call option gives the holder (buyer) the right, but not the obligation, to buy an underlying asset at a specified price (strike price) within a predetermined period (until expiration). Call options are typically purchased when the investor expects the price of the underlying asset to rise.

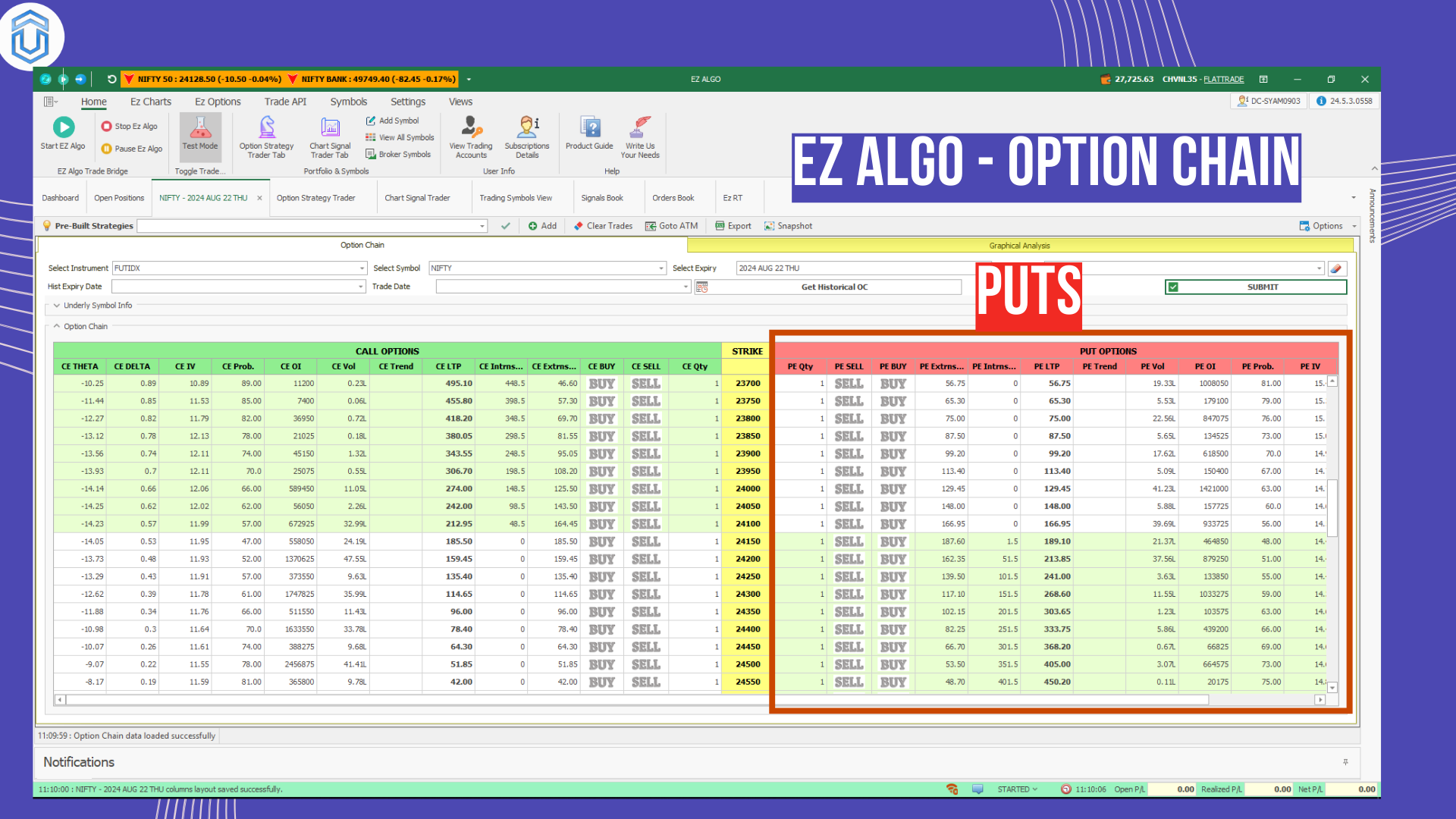

Put Option:

In the option chain window, the right side represents the Put Options. Put Options are market with red rectangle.

A put option gives the holder (buyer) the right, but not the obligation, to sell an underlying asset at a specified price (strike price) within a predetermined period (until expiration). Put options are typically purchased when the investor expects the price of the underlying asset to fall.

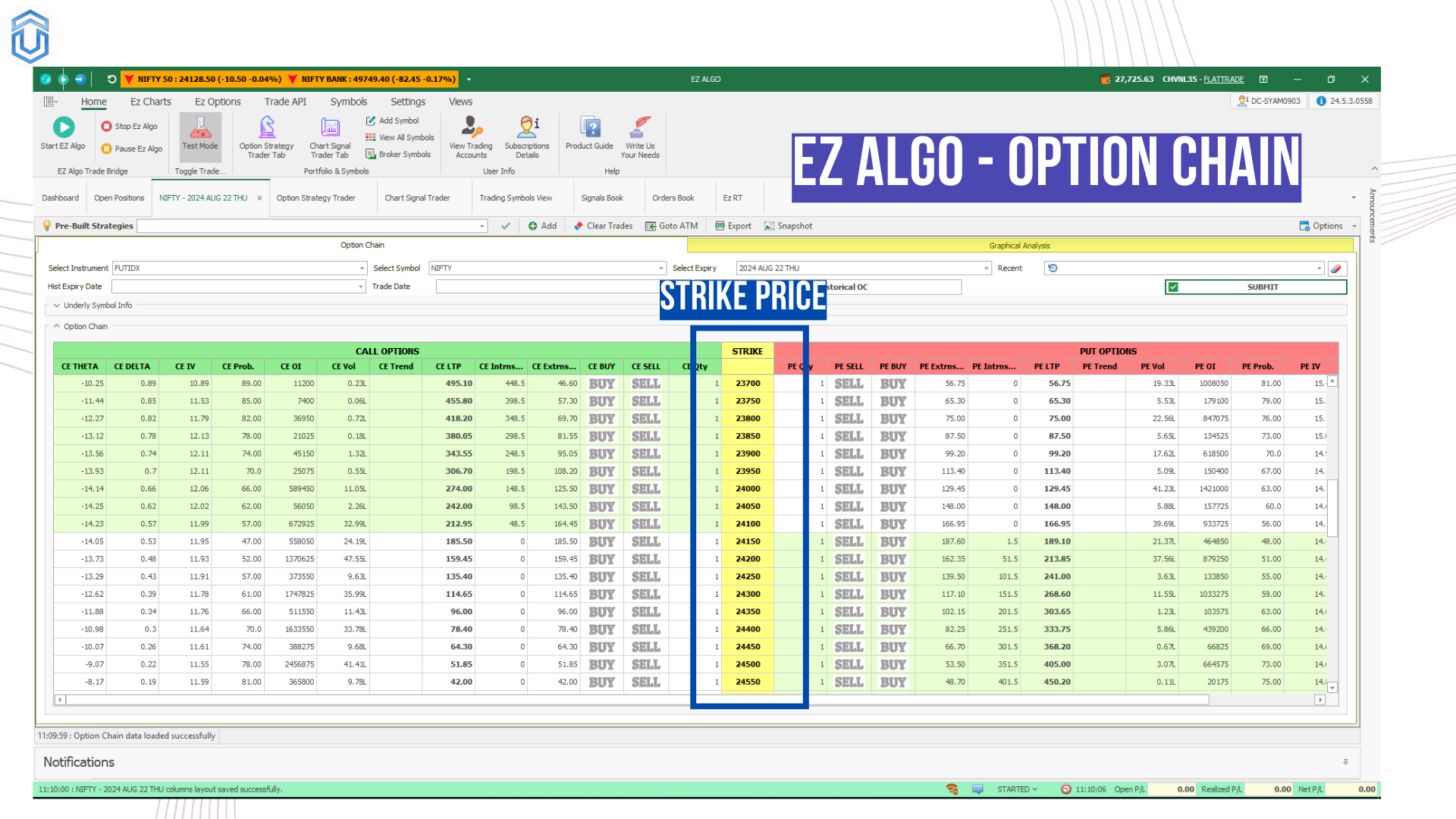

Strike Price in an Option Chain:

The strike price, also known as the exercise price, is a crucial component in an option chain. It is the price at which the holder of the option can buy (for a call option) or sell (for a put option) the underlying asset.

In an option chain, which lists all the available options for a particular underlying asset, the strike prices are typically displayed in a column in the center of the option chain window. The strike price determines the price level at which the option can be exercised.

For example, in the above image Nifty Option Chain is loaded. You can see the strike price in the center which has been marked in blue rectangle. Nifty strike prices are displayed in the interval of 50 points. The premium changes accordingly to the strike prices.

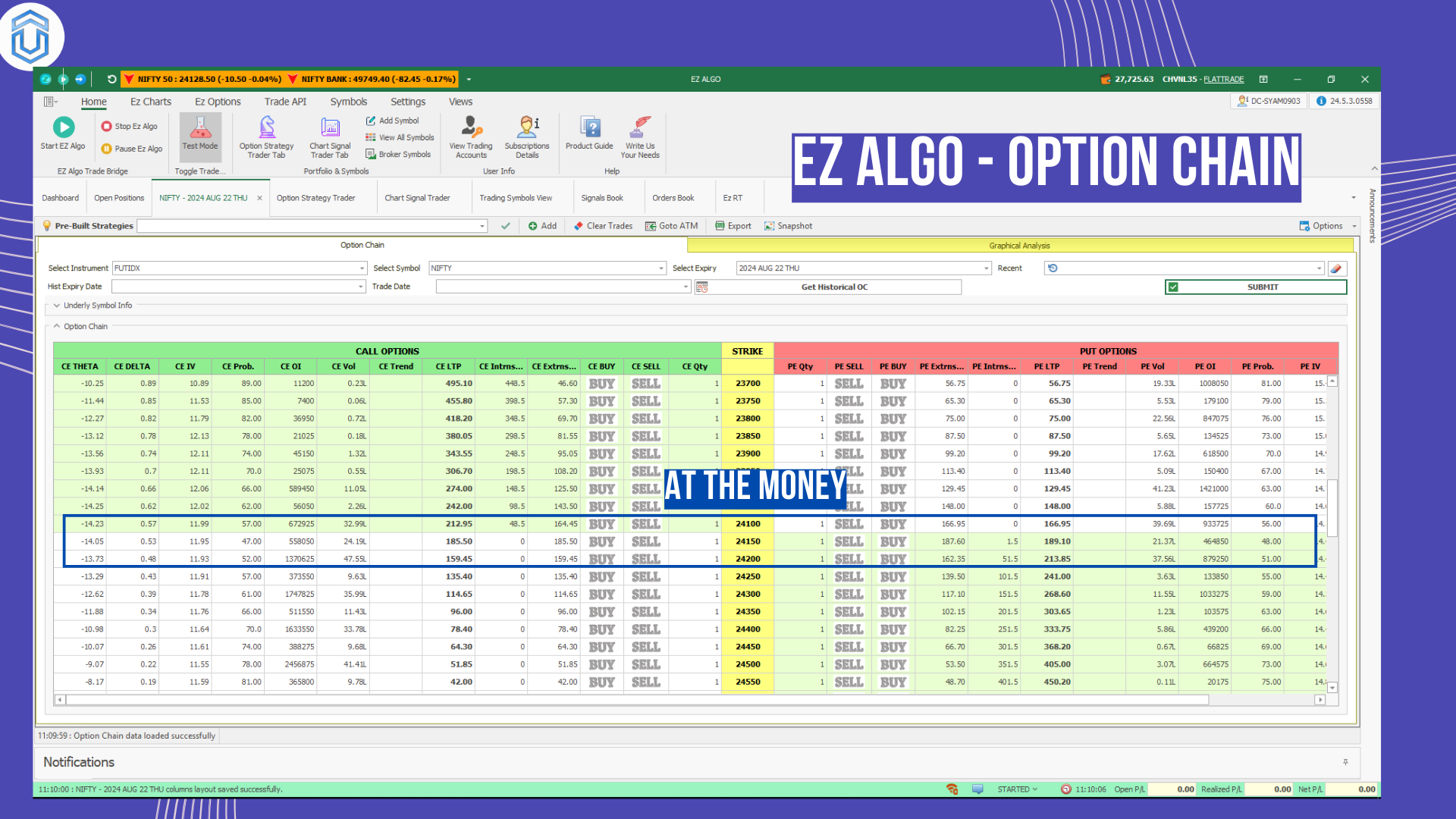

At-the-money option (ATM):

At-The-Money or ATM defines a situation wherein the strike price of a put or a call option is equivalent to the current market price of an underlying asset.

Underlying price = Strike Price

(Note : It’s just an assumption. Strike price nearest to underlying can be taken as ATM, since the underlying price is always variable).

For example, look at the above Nifty option chain. The underlying value of Nifty is ₹ 24,128.50. In the Nifty strike prices, the price close to 24,128 is 24,150. This is considered as At-the-money options.

For both call and put options, at-the-money strike prices are same. At the money contracts are traded often as it reflects the underlying value. At the money has no Intrinsic value in it. It has only extrinsic and Implied volatility values.

ATM contracts premium are less compared to In-the-money and more compared to out-of-the-money contracts.

In-the-money option (ITM):

In the money (ITM) is a term used in options trading to describe a situation where an option has intrinsic value. Here’s how it applies to call and put options:

For Call Options : A call option is considered “in the money” when the current price of the underlying asset is above the option’s strike price.

Underlying price > Strike Price

For example, look at the above Nifty option chain. The underlying value of Nifty is 24,128.50. In the Nifty strike prices, the price less than 24,128.50 are all considered In-the-money for call options. For example, 24100, 24050, 24000…….

For Put Options : A put option is “in the money” when the current price of the underlying asset is below the option’s strike price.

Underlying price < Strike Price

For example, look at the above Nifty option chain. The underlying value of Nifty is 24,128.50. In the Nifty strike prices, the price above 24,128.50 are all considered In-the-money for put options. For example, 24150, 24200, 24250…..

Being in the money means that the option has intrinsic value and can be exercised for a profit. The further in the money an option is, the more intrinsic value it has, which generally results in a higher premium.

Out-of-the-money option (OTM):

Out-of-the money (OTM) is a term used in options trading to describe a situation where an option has no intrinsic value. Here’s how it applies to call and put options:

For Call Options : A call option is considered “out of the money” when the current price of the underlying asset is below the option’s strike price.

Underlying price < Strike Price

For example, look at the above Nifty option chain. The underlying value of Nifty is 24,128.50. In the Nifty strike prices, the prices above 24,128.50 are all considered Out-of-the-money for call options. For example, 24150, 24200, 24250…..

For Put Options : A put option is “out of the money” when the current price of the underlying asset is above the option’s strike price.

Underlying price > Strike Price

For example, look at the above Nifty option chain. The underlying value of Nifty is 24,128.50. In the Nifty strike prices, the price below 24,128.50 are all considered out-of-the-money for put options. For example, 24100, 24050, 24000…..

OTM options have no intrinsic value, but they may still have time value and potentially some extrinsic value based on factors like the time remaining until expiration and the volatility of the underlying asset.

Intrinsic Value of an option contract:

Intrinsic value is a key concept in options trading that represents the actual value of an option if it were exercised immediately.

It measures how much an option is “in the money” and is calculated based on the difference between the underlying asset’s current price and the option’s strike price.

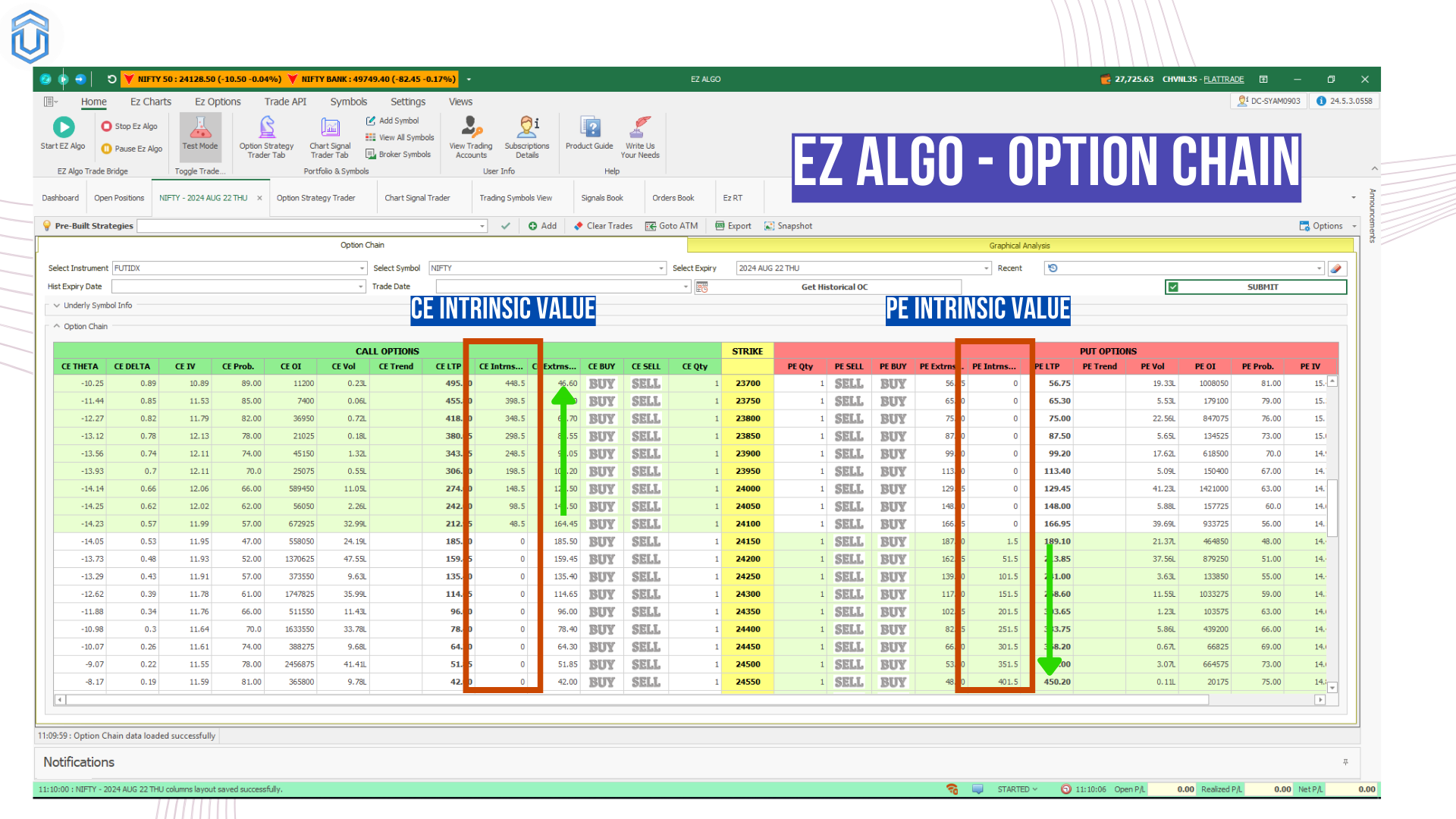

Look at the image above. Nifty option chain is loaded. In that Intrinsic value of both call and put option for each contract is given. The intrinsic value column is marked in red rectangle.

If you closely observe, the intrinsic value increases as we move towards in-the-money option contracts. As the difference between the strike price and the underlying price increases, so does the intrinsic value.

Here’s how intrinsic value works for both call and put options:

For Call Options :

Intrinsic Value = Current Price of the Underlying Asset – Strike Price

A call option has intrinsic value when the current price of the underlying asset is above the strike price.

For example, if the current price of the stock is 24,100 and the strike price of the call option is 24,000, the intrinsic value of the call option is ₹ 100 (24100 – 24000).

For Put Options :

Intrinsic Value = Strike Price – Current Price of the Underlying Asset

A put option has intrinsic value when the current price of the underlying asset is below the strike price.

For example, if the current price of the stock is 24,100 and the strike price of the put option is 24,200, the intrinsic value of the put option is ₹ 100 (24200 – 24100).

Intrinsic value does not account for any additional value an option might have due to time remaining until expiration or the volatility of the underlying asset. That additional value is known as the time value.

The total premium of an option is the sum of its intrinsic value and its time value.

Extrinsic Value of an option contract:

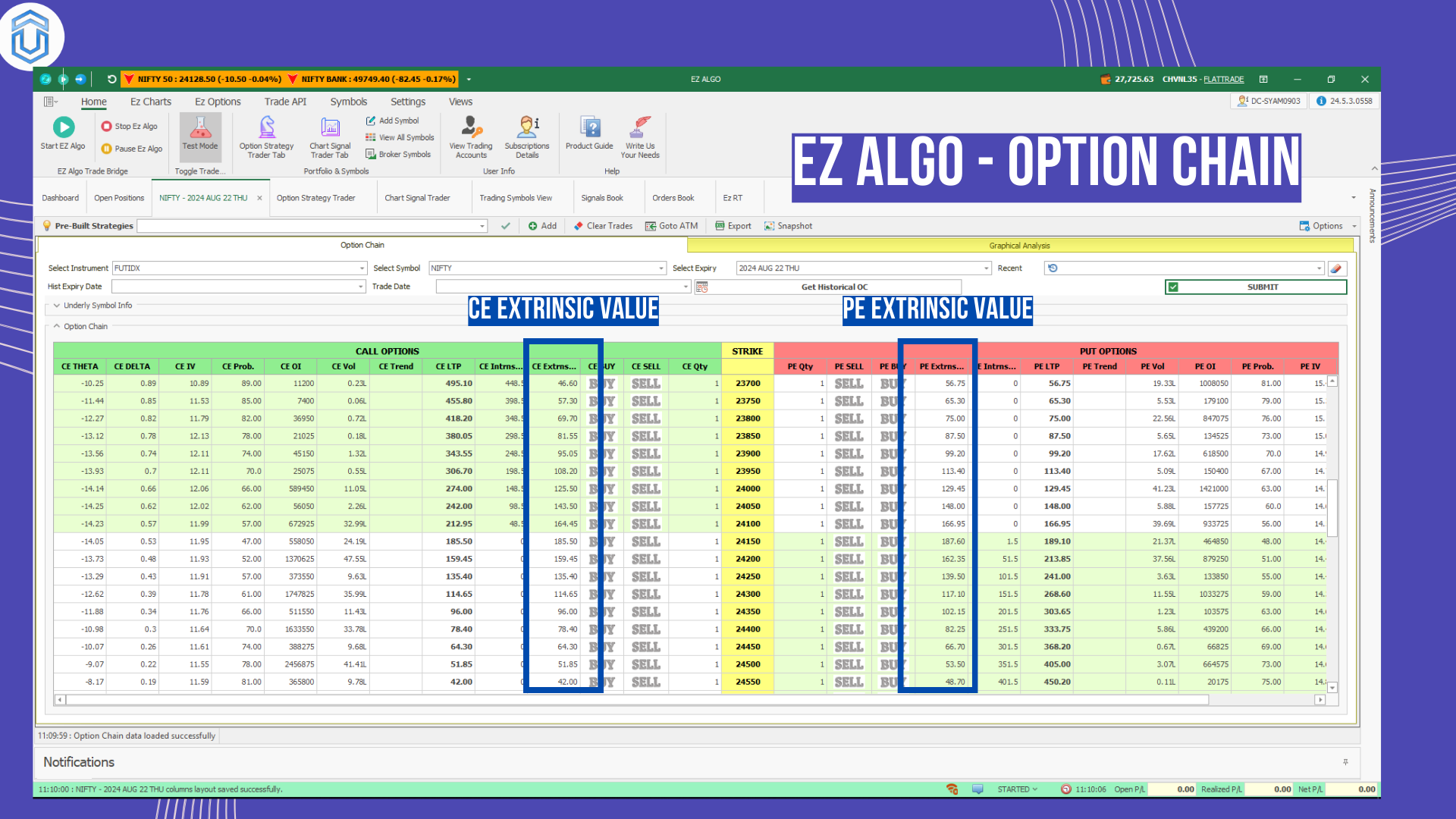

Extrinsic value, also known as time value, is the portion of an option’s total premium that is attributed to factors other than the intrinsic value. It represents the additional amount an investor is willing to pay for the potential of future profitability.

Look at the image above. Nifty option chain is loaded. In that Extrinsic value of both call and put option for each contract is given. The Extrinsic value column is marked in blue rectangle.

If you closely observe, the extrinsic value decreases as we move towards out-of-the-money option contracts.

Extrinsic value is generally higher for at-the-money (ATM) option contracts because they have a greater probability of moving into the money. This is due to their proximity to the underlying asset’s current price, which means there is a significant chance of them becoming profitable as the asset price fluctuates.

Extrinsic value of an option is calculated by taking the difference between the market price of an option (also called the premium) and its intrinsic price – the value of an options contract in relation to the underlying at expiration or if exercised.

Extrinsic Value = Option Premium – Intrinsic Value

The various factors that influence Extrinsic values are

- Time

- Volatility

- Interest Rates

- Dividends

Open Interest and Volume in Option Chain :

In an option chain, open interest and volume are key metrics that provide insights into the trading activity and liquidity of options. Here’s what each term means:

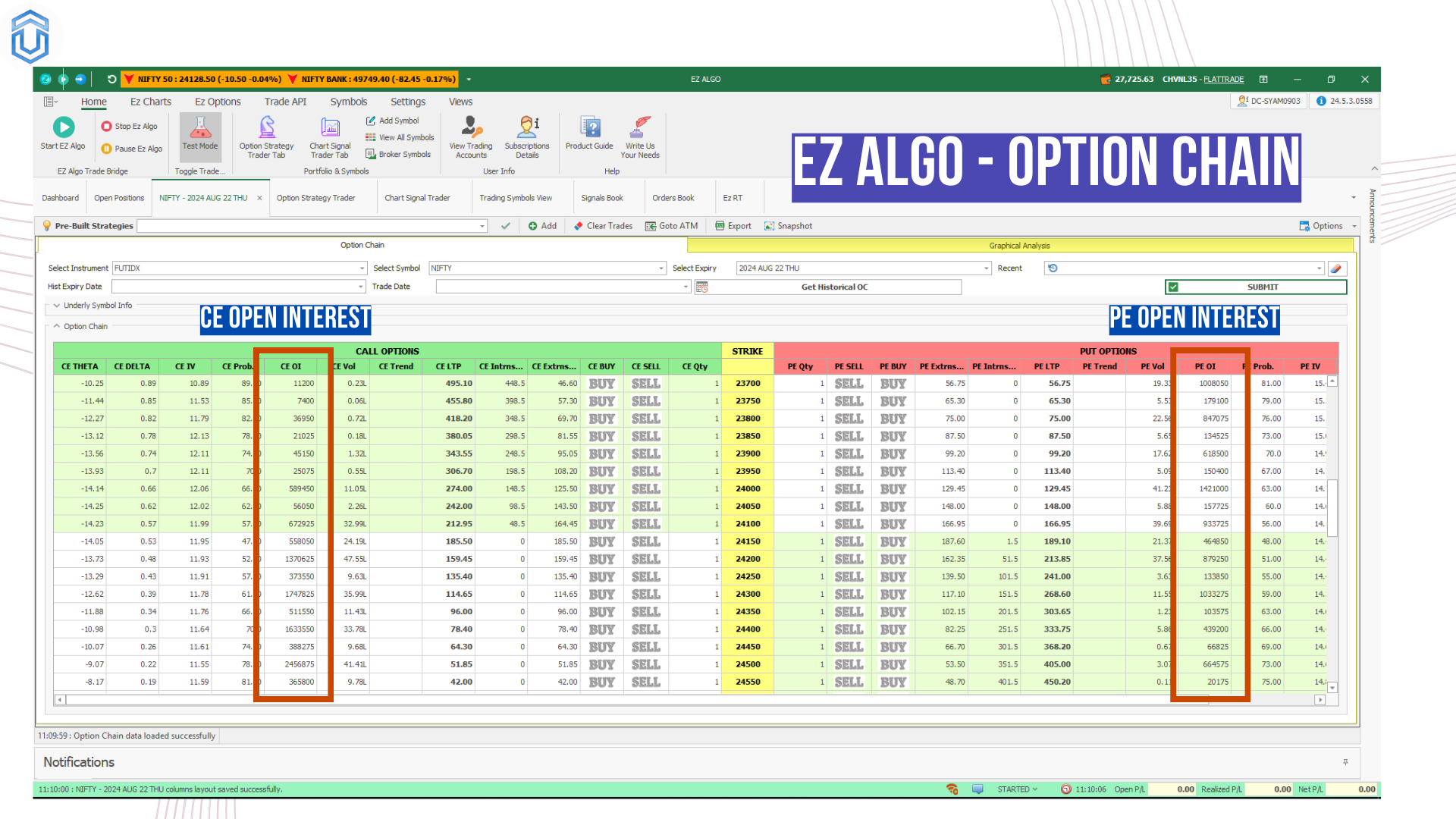

Open Interest :

Open interest refers to the total number of outstanding option contracts (either call or put) that are held by market participants at a given time. It represents the number of active contracts that have not yet been settled or closed.

Look at the Nifty Option chain. Open Interest for all the strike prices of calls and puts are loaded in columns (marked in red rectangle).

Higher open interest generally indicates higher liquidity, meaning that there are more contracts available for trading, which can lead to tighter bid-ask spreads.

Changes in open interest can signal market sentiment or trends. For example, increasing open interest might suggest that new positions are being established, while decreasing open interest might indicate that positions are being closed.

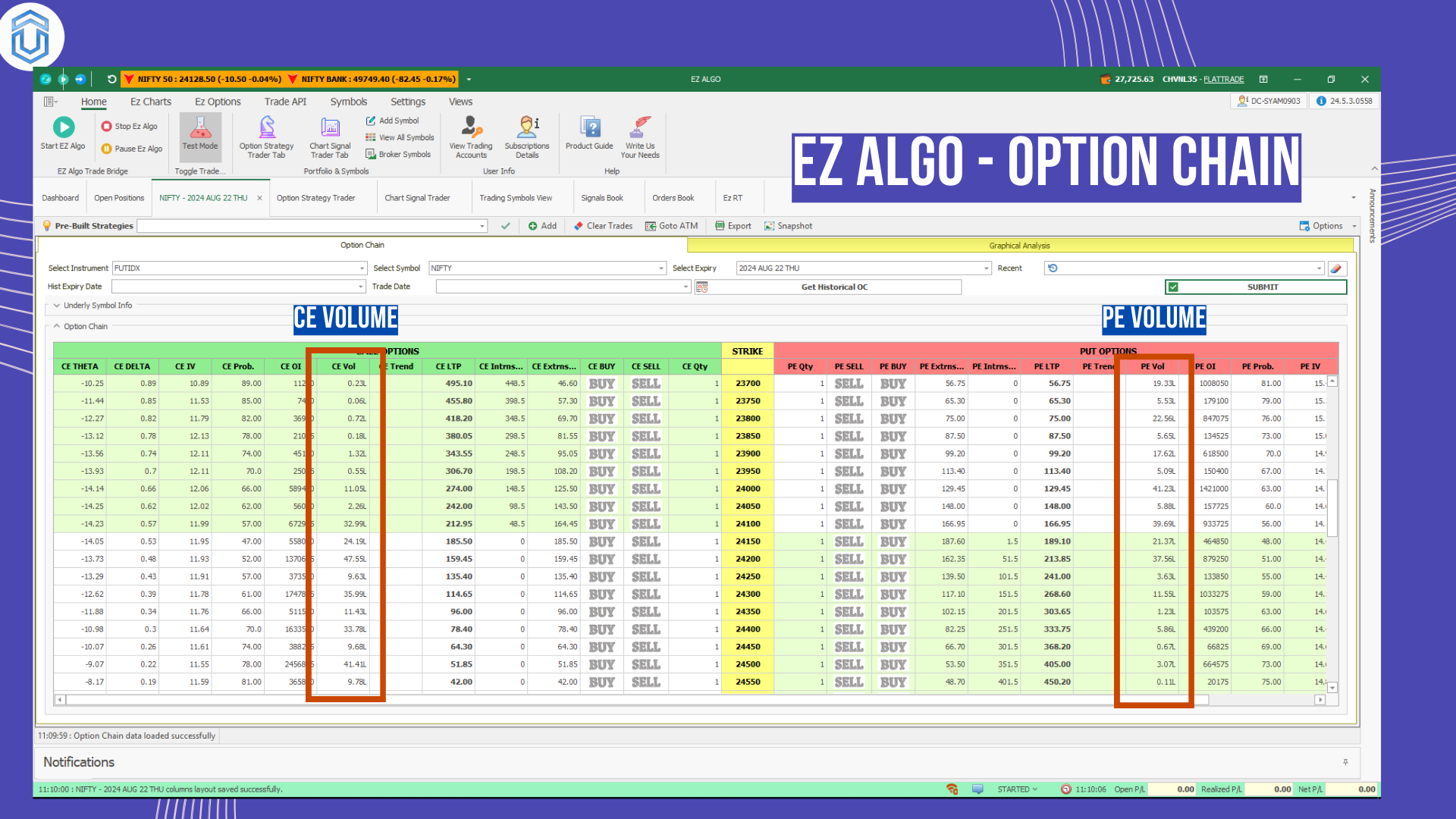

Volume :

Volume refers to the total number of option contracts that have been traded during a specific period (usually within a trading day). It represents the total number of contracts bought and sold.

Look at the Nifty Option chain. Volume for all the strike prices of calls and puts are loaded in columns (marked in red rectangle).

High volume indicates a high level of trading activity and can reflect strong interest or significant events related to the underlying asset.

Like open interest, higher volume can also suggest better liquidity in the market, making it easier to enter or exit positions.

Volume can be an indicator of market movement or price trends. Significant changes in volume can sometimes precede price changes or indicate strong market sentiment.

Option Greeks :

Option Greeks are a set of measures that describe how the price of an option changes in response to various factors. They are essential tools for options traders to understand and manage the risks and rewards associated with options trading.

They are :

Delta (Δ):

Delta measures the sensitivity of an option’s price to changes in the price of the underlying asset.

Specifically, it represents the amount by which the price of the option is expected to change for a 1-point change in the underlying asset’s price.

For call options, delta ranges from 0 to 1; for put options, delta ranges from 0 to -1.

Gamma (Γ) :

Gamma measures the rate of change of delta with respect to changes in the price of the underlying asset.

In other words, it shows how much delta is expected to change as the underlying asset’s price changes.

Theta (Θ) :

Theta measures the sensitivity of an option’s price to the passage of time, also known as time decay.

It represents the amount by which the option’s price is expected to decrease as it approaches expiration, assuming all other factors remain constant.

Vega (ν) :

Vega measures the sensitivity of an option’s price to changes in the volatility of the underlying asset.

It represents the amount by which the option’s price is expected to change for a 1% change in the implied volatility of the underlying asset.

Look at the Nifty Option Chain. Option Greeks Delta and Theta values are marked in rectangle for both call and put option.

Conclusion :

Navigating the option chain effectively is crucial for both novice and experienced options traders. By understanding key concepts such as strike prices, open interest, volume, and the Option Greeks—Delta, Gamma, Theta, Vega, and Rho—traders can make more informed decisions and better manage their risk and reward profiles.

An option chain provides a comprehensive view of available options for a given underlying asset, detailing various strike prices and expiration dates.

Open interest and volume offer insights into market activity and liquidity, helping traders gauge the level of interest and potential ease of entering or exiting positions.

In summary, mastering the elements of an option chain and the Greeks equips traders with the tools needed to navigate the complexities of options trading. This knowledge not only facilitates more strategic decision-making but also enhances the ability to optimize trading strategies and manage risks effectively.

Thanks for reading!