In the financial market, there are plenty of trading and investment instruments available for traders. One of the most attractive instruments is Options Trading. Options can generally be categorized into two main types: Call Options and Put Options. The main attractive features of Options Trading is the High Leverage, which has swiftly captivated a wider audience in a shorter period of time.

Traders can take positions with a minimum amount of the entire transaction value, known as the Premium. With low capital requirements, traders can achieve high profits. Profitability in options trading depends on factors such as the movement of the underlying asset, the strike price, and market volatility.

Exploring the intricacies of options trading, this article delves into the specifics of Call options. Let’s dive right in!

1. What is a Call Option? Understanding the basics

-

- A call option gives the holder (buyer) the right, but not the obligation, to buy an underlying asset at a specified price (strike price) within a predetermined period (until expiration). Call options are typically purchased when the investor expects the price of the underlying asset to rise.

-

- The seller of a call option the seller (writer) has the obligation to sell the specified quantity of the underlying asset at the strike price if the buyer decides to exercise the option.

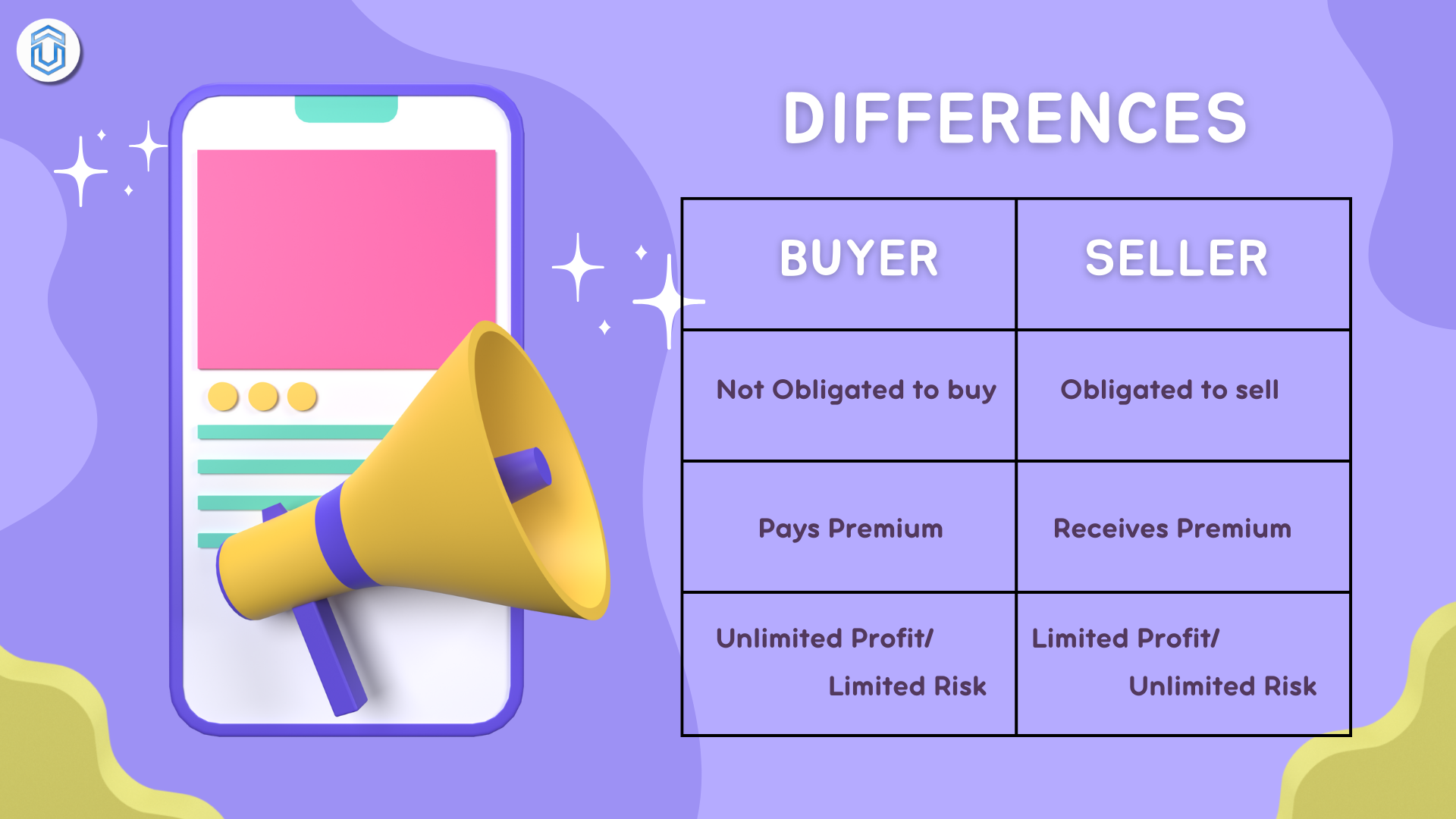

From the above two definitions we can conclude that, a call option contract has two players. One is the buyer of the contract – Options Buyer (Holder) and another one is the seller of the options contract – Options Seller (Writer).

Look at the chart below of the key points about both call option buyer and seller.

| Features | Call Option Buyer Holder | Call Option Seller Writer |

|---|---|---|

| Rights | The buyer of a call option has the right to buy, but not the obligation to buy | The seller of a call option (writer) has the obligation to sell, if the buyer decides to exercise the option. |

| Views | Buyers typically expect the price of the underlying asset to rise (bullish outlook) | Sellers may expect the price to remain stable or even decrease (neutral to bearish outlook) |

| Premium | The buyer pays a premium to the seller (writer) of the call option. This premium is the price of the option and compensates the seller for taking on the obligation to sell the asset if the buyer decides to exercise the option. | In exchange for taking on the obligation, the seller receives a premium from the buyer upfront. This premium is the seller's compensation for undertaking the potential obligation to sell the asset. |

| Profit | The profit potential is theoretically unlimited because the asset price can rise indefinitely. If the call option rises above the strike price plus the premium, buyer sees an unlimited profit profile. | The maximum profit for the seller of a call option is the premium received. This occurs if the option expires worthless (i.e., the underlying asset price does not exceed the strike price by expiration). |

| Risk | Risk is limited to the premium paid | Unlimited risk when the stock moves up |

2. Understanding call options with an example

Call Option Buyer

Let us assume that the stock of a company Z, currently trading at ₹ 100 per share. Now a trader named Sam believes that the company Z, has the potential to rise nearly 30 points in 3 months. So he decides to buy a call option of that company.

Sam purchase an option contract @ strike price 130. Assume the price of the contract is ₹ 10 per share. He pays ₹ 10 * 100 = ₹ 1000 (assume each options contract equal to 100 shares) as premium for the stock.

His purchase details :

Strike price : ₹ 130

Expiry : 3 months from now

Premium : ₹ 10 * 100 = ₹ 1000

Now Sam has the right to buy 100 shares of company Z @ ₹ 130 per share any time before the expiry of the contract. Even when the stock price move beyond 130, he can buy the share at ₹ 130 from the seller.

The seller of the contract is obligated to sell the contract to the buyer, when Sam exercise his option. The benefit lies with the buyer because he has taken the risk by paying a premium to the seller.

Profit calculation for call option buyer :

Assume that the share price of the company Z, moved to ₹ 150 per share before expiry. Now Sam will exercise the contract. His profit will be,

Sell price – Buy price – Premium = Profit

₹ 150 – ₹ 130 – ₹ 10 (premium) = ₹ 10 per share

Total profit = ₹ 10 * 100 = ₹ 1000

His Profit = Unlimited (Think that what if the stock goes beyond that level)

Think of this. Everyone is buying 20kg rice for ₹ 1000 from the market. You can buy same amount of rice for just ₹ 700 from a seller, because you have made a contract and paid an advance to the seller 30 days before. It’s the same with the options contract.

Loss calculation for call option buyer :

Let’s see what will happen if the stock Z, doesn’t move as per the prediction of Sam. Look at this scenario.

Before the expiry, the stock moves to ₹ 120. Now there is no use for the buyer to exercise his contract as the stock is available in the marker below his contract price. So he never exercise his contract as he is not obligated to buy the contract. His loss will be,

His Loss = Premium (Limited)

In that way, his loss is limited to the premium paid. Sam’s loss is ₹ 1000.

Think of this. Rice price has fallen. Everyone is buying 20kg rice for ₹ 600 from the market. You have made the contract to buy same amount of rice at ₹ 700 from a seller. Will you go and buy? Because the market rate is much below the contract rate, there is no point in buying the rice @ ₹ 700, when it is available @ ₹ 600 from the open market. It’s the same with the options contract.

Call Option Seller

Let us see the Call option seller profile. Assume that the stock of a company Z, currently trading at ₹ 100 per share. Our call option seller Ram believes that the price of the company Z will either remain stable or decrease. So he decides to sell a call option of that company. The seller always profit from the passage of time (theta decay) and from decreases in volatility (Vega).

Ram sells an option contract @ strike price 130 and collects a premium of ₹10 per share from the buyer. He collects ₹ 10 * 100 = ₹ 1000 (assume each options contract equal to 100 shares) as premium from the buyer of the contract Sam.

His purchase details :

Strike price : ₹ 130

Expiry : 3 months from now

Premium received : ₹ 10 * 100 = ₹ 1000

The seller of the contract, Ram is obligated to sell the contract to the buyer, when Sam exercise his option. The benefit lies with the buyer because he has taken the risk by paying a premium to the seller.

Profit calculation for call option seller :

Let’s see what will happen if the stock Z, moves as per the prediction of Ram. Look at this scenario.

Before the expiry, the stock moves to ₹ 120. Now there is no use for the buyer to exercise his contract as the stock is available in the marker below his contract price. So he never exercise his contract as he is not obligated to buy the contract. Hence the seller, Sam will pocket the premium he received from the buyer.

His Profit = Premium received (Limited)

Loss calculation for call option seller :

Assume that the share price of the company Z, moved to ₹ 150 per share before expiry. Now Sam, the buyer will exercise the contract. Hence the seller, Ram is obligated to sell the contract to the buyer.

His loss will be,

Premium – (buy price – sell price)

₹ 10 – (₹ 150 – ₹ 130) = ₹ 10 – ₹ 20

= ₹ 10 * 100 = ₹ 1000

His Loss = Unlimited (When the stock keeps on moving in the upper direction call option seller experience unlimited loss)

3. Margin Requirements

The margin requirements for call option buyers and sellers differ based on their roles and the type of options they are dealing with. Here’s an overview of the margin requirements for each:

Margin Requirements for Call Option Buyers

- Initial Margin : Call option buyers do not typically have to pay an initial margin when they purchase an option. They pay the premium upfront, which is the cost of buying the option contract.

- Premium Payment : The premium paid by the buyer is the maximum amount they can lose. It is the only financial commitment they make when purchasing the call option.

- Margin Account : Depending on the broker and the type of account, some brokers may require option buyers to have a margin account, especially for complex or higher-risk strategies. However, this is not universally required for all options purchases.

Margin Requirements for Call Option Sellers

- Initial Margin : Call option sellers (writers) are required to maintain an initial margin, which is a percentage of the notional value of the underlying asset. The initial margin is a security deposit held by the broker to cover potential losses that the seller might incur if the option is exercised.

- Maintenance Margin : Sellers may also need to maintain a maintenance margin, which ensures that they can cover potential losses as the price of the underlying asset fluctuates.

- Margin Call : If the price of the underlying asset moves unfavorably against the seller (i.e., the asset price increases significantly in the case of a call option seller), the broker may issue a margin call. This requires the seller to deposit additional funds into their margin account to meet the minimum margin requirement.

- Risk Considerations : The margin requirements for call option sellers are designed to manage the risk associated with their obligation to potentially deliver the underlying asset if the option is exercised. Since the potential loss for sellers are unlimited, brokers impose margin requirements to ensure they can cover potential losses.

4. Call options and its types

There are a few types of call options that investors commonly use :

- American Call Option: This type of option can be exercised by the holder at any time before or on the expiration date of the option.

- European Call Option : This option can only be exercised on the expiration date itself, not before.

- Bermudan Call Option : This is a hybrid of American and European options, allowing exercise on specified dates before expiration as well as on the expiration date.

In India, both American and European style options are traded, but the most common type is the European style option.

- European Call Option : This type of option can only be exercised on the expiration date itself. This is the standard type of option traded on the National Stock Exchange of India (NSE) and other Indian exchanges for equity options.

- American Call Option : This type of option can be exercised at any time before or on the expiration date. While less common than European options in India, American style options are also available on certain exchanges for specific products such as index options.

5. Difference between exercising and selling a call option

Exercising and selling a call option are two different actions that an option holder can take, each with its own implications:

Exercising a Call option :

When you exercise a call option, you are using your right to buy the underlying asset (such as stocks, commodities, or other financial instruments) at the strike price specified in the option contract. By exercising, you are essentially converting the call option into the underlying asset itself.

In the previous example, Sam hold a call option on 100 shares of Z stock with a strike price of ₹ 130, exercising the option means you can buy 100 shares of Z stock at ₹ 130 per share.

Selling a Call Option (Closing the Position) :

This can be done at any time before the expiration date of the option. The sale of the call option contract transfers the rights and obligations associated with the option to another party.

Selling a call option can be done for several reasons, including taking profits if the option price has risen since you bought it, cutting losses if the option price has fallen, or simply to exit a position if market conditions have changed.

If the Company Z stock have moved to ₹ 150 within 20 days, then Sam need not wait for the expiry date. he can sell the call option contract in the open market and can pocket the profit. Here the rights and obligations are transferred to another buyer.

6. Choosing the right strike price for call options

In equity trading, the focus is primarily on analyzing stocks and executing orders based on perceived profitable opportunities. However, options trading introduces an additional layer of complexity.

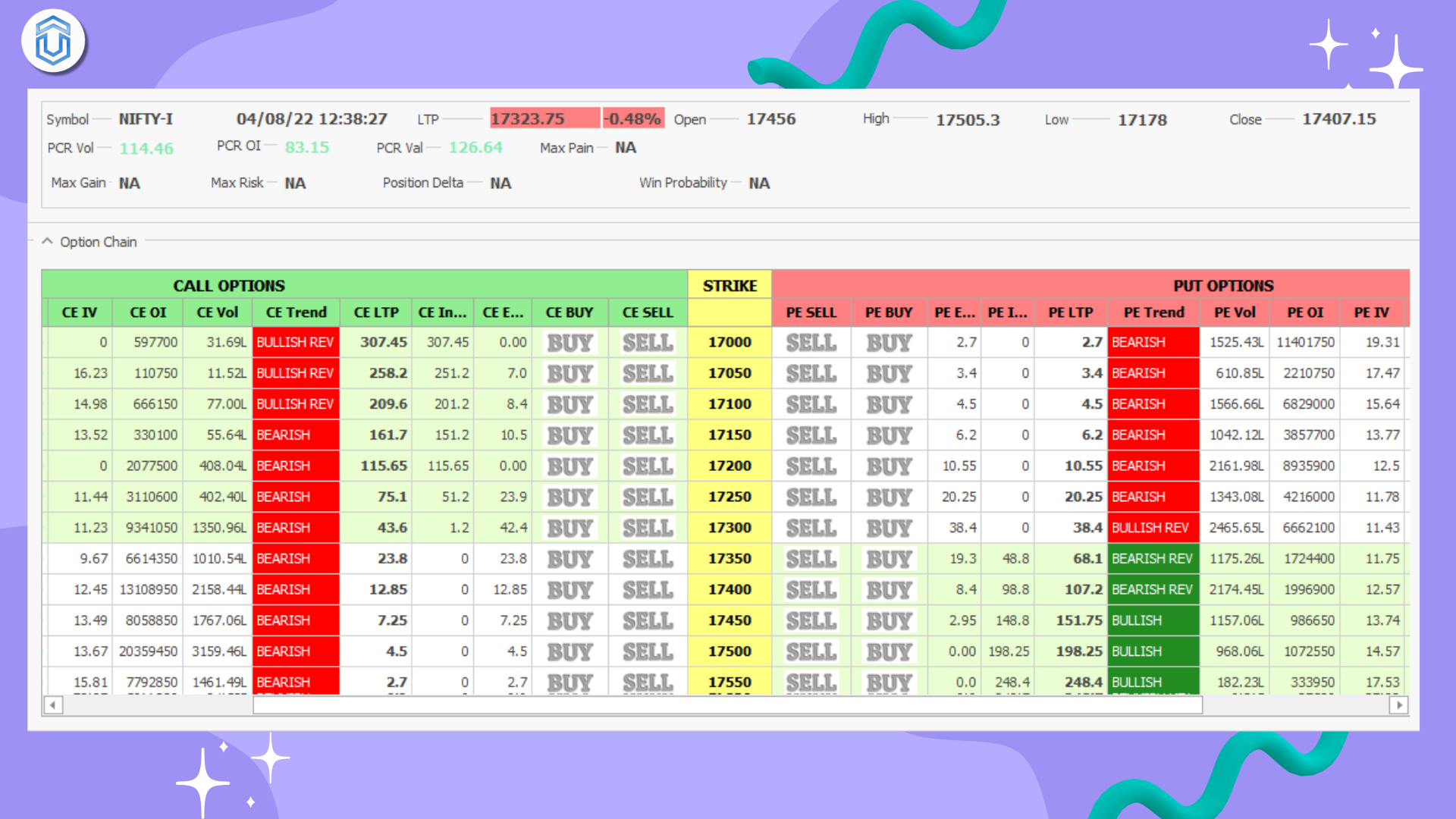

Alongside selecting the underlying stock, traders must navigate the options chain to pinpoint the optimal strike price. An options chain displays a range of strike prices available for a particular expiration date, providing choices that cater to varying market conditions and strategies.

Look at the option chain for Nifty Future Index. When trading options on the Nifty Futures Index, traders have a range of strike prices available to choose from. Each strike price represents a specific level at which the option can be exercised. Traders pay a premium for the right to buy or sell the Nifty Futures Index at that strike price within a specified period.

Choosing the right strike price in call options depends on your options trading strategy and market outlook.

Here’s a simple approach to help you decide :

Understand Your Outlook :

Determine whether you think the price of the underlying asset (in this case, the Nifty Futures Index) will go up, down, or stay relatively stable.

Types of Strike Prices :

- At-the-Money (ATM) : Choose a strike price that is closest to the current price of the Nifty Futures Index. For example, if the Nifty Futures Index is trading at 15,000, an ATM call option might have a strike price of 15,000.

- Out-of-the-Money (OTM) : Select a strike price above the current Nifty Futures Index price if you expect the index to rise. For instance, if the Nifty is at 15,000 and you expect it to go up, you might consider an OTM call option with a strike price of 15,100.

- In-the-Money (ITM) : Choose a strike price below the current Nifty Futures Index price if you believe the index will continue to rise. For example, if the Nifty is at 15,000 and you are bullish, an ITM call option might have a strike price of 14,900.

Consider Timeframe : Determine how long you expect it will take for the Nifty Futures Index to move as you predict. Options have expiration dates, so choose a strike price with an expiration that matches your timeframe.

Risk Tolerance : Assess how much risk you are willing to take. Generally, OTM options are cheaper but have a lower chance of expiring profitably, while ITM options are more expensive but have a higher chance of being profitable if the index moves as expected.

Evaluate Premium : Compare the premiums (costs) of different strike prices. Ensure the potential profit aligns with the risk you are taking and your trading goals.

In practice, traders often employ a mix of strike prices based on their outlook and risk management strategy. There’s no single “best” strike price; it depends on your analysis, risk tolerance, and trading goals. It can also be beneficial to practice with virtual trading platforms or start with smaller positions to gain experience in choosing strike prices effectively.

7. Understanding the Payoff Graph of Call Options

Understanding the payoff graph of call options is essential for traders to visualize potential profits and losses based on different scenarios involving the underlying asset’s price at expiration.

Here’s a detailed explanation of the payoff graph for call options :

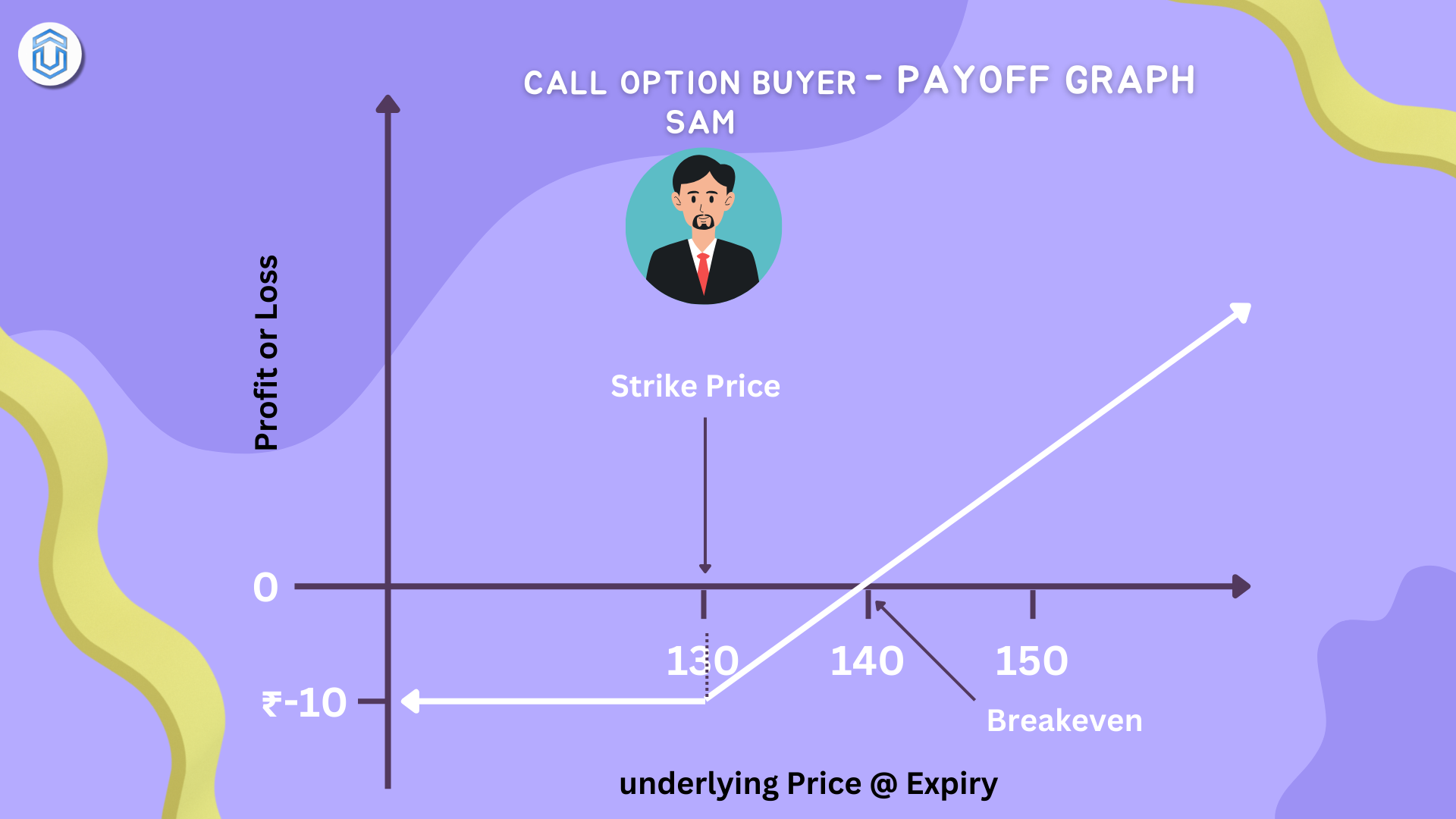

While plotting Payoff graph, remember that there are three key variables to consider. Strike price, Expiration date, and Premium. We will plot the payoff graph from our previous example Sam and Ram.

Call Option Buyer Payoff Graph

Sam bought Company Z @stike price ₹ 130. For that he pays a premium of ₹ 10. Look at the graph of Sam’s profile. His loss is capped to ₹ 10, while his profit is unlimited. If the stock moves beyond ₹ 140 (strike price + premium), his profit is unlimited.

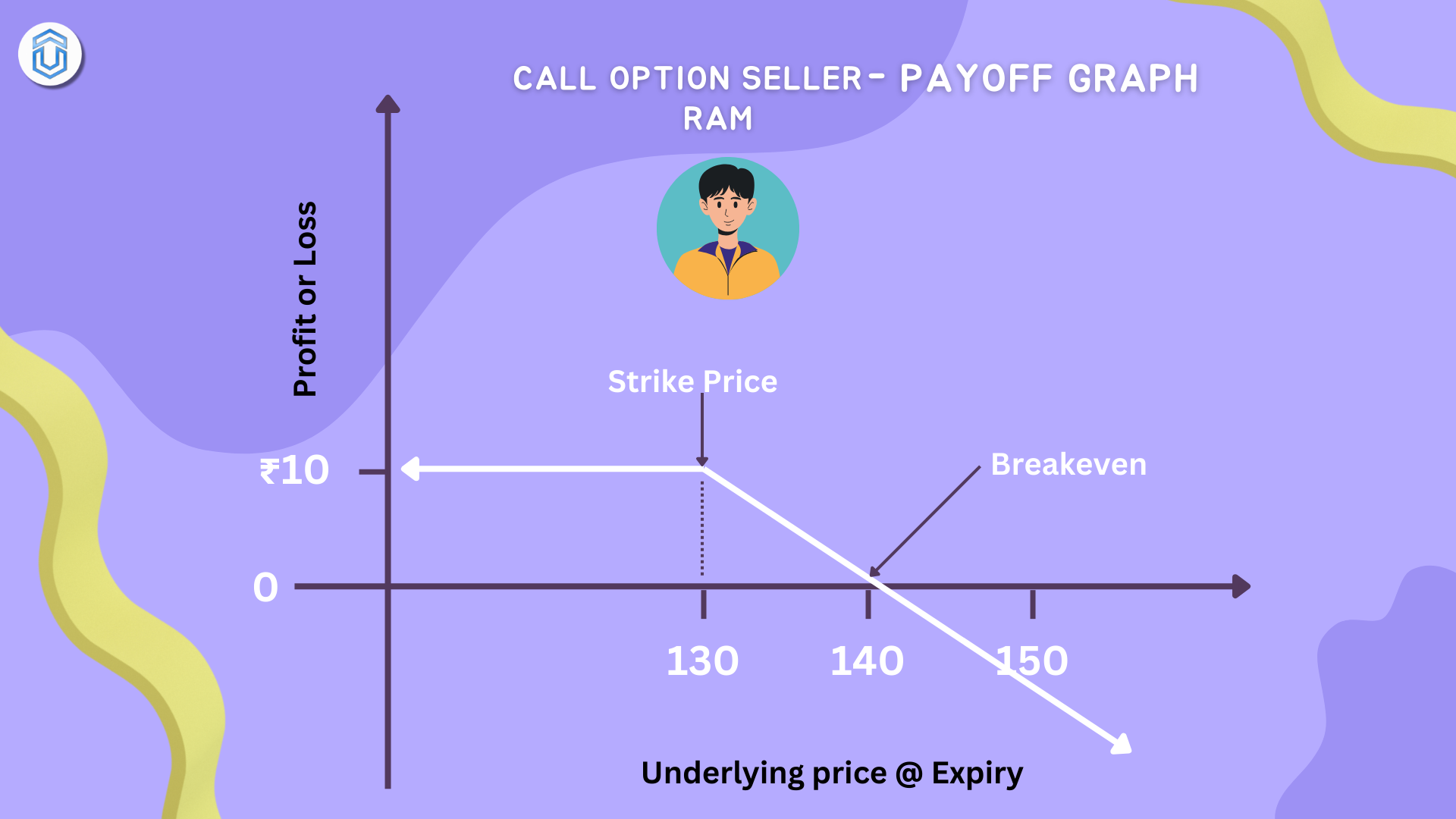

Call Option Seller Payoff Graph

Ram sold Company Z @stike price ₹ 130. For that he received a premium of ₹ 10. Look at the graph of Ram’s profile. His profit is capped to ₹ 10, while his loss is unlimited. If the stock moves beyond ₹ 130, he starts to lose his profit. After 140, his loss is unlimited.

8. Difference between Long and Short call option

The main difference between a long call option and a short call option lies in the position and strategy of the trader or investor.

Long Call Option :

- Position : A trader buys a call option contract, which gives them the right (but not the obligation) to buy the underlying asset (e.g., stocks, index) at a predetermined price (strike price) within a specified period (until expiration).

- Objective : The objective of holding a long call option is to profit from an expected increase in the price of the underlying asset.

- Risk : The maximum loss for the buyer of a long call option is limited to the premium paid for the option. This occurs if the price of the underlying asset remains below the strike price at expiration, and the option expires worthless.

Short Call Option :

- Position : A trader sells a call option contract, creating an obligation to sell the underlying asset at the strike price if the buyer of the option decides to exercise it.

- Objective : The seller (writer) of a short call option aims to profit from the premium received upfront. They expect the price of the underlying asset to remain below the strike price, causing the option to expire worthless.

- Risk : The risk for the seller of a short call option is potentially unlimited. If the price of the underlying asset rises significantly above the strike price, the seller may incur losses proportional to the extent of the rise, as they must deliver the asset at the lower strike price.

9. Conclusion

Call options offer versatile opportunities for investors and traders alike, providing strategic ways to capitalize on potential price movements in the financial markets. Whether used for speculative purposes, hedging against downside risk, or generating income through option premiums, understanding the dynamics of call options is essential.

In essence, call options provide a powerful tool for investors to optimize their investment strategies, offering flexibility, leverage, and the potential for enhanced returns. However, due diligence, thorough analysis, and a clear understanding of both opportunities and risks are paramount for success in trading call options.