The top 10 highest return stocks in India for 2024. This list highlights the most promising investments based on recent performance and growth potential, helping you identify high-yield opportunities in the Indian stock market.

Introduction

The Indian stock market has been a hotspot for investors in 2024, driven by a mix of robust economic recovery, technological advancements, and a renewed focus on sustainability. The year has been particularly notable for several stocks that have delivered stellar returns, reflecting not just their individual strengths but also broader market trends such as digital transformation, green energy transition, and infrastructure development.

In this blog post, we will explore the top 10 highest return stocks in India for 2024. These stocks have not only outperformed their peers but also demonstrated resilience and adaptability in a dynamic market environment. Whether you’re a seasoned investor or new to the market, understanding the factors behind the success of these top-performing stocks can provide valuable insights and help you make informed investment decisions for the future.

Top 10 Stocks with the Highest Returns - 2024

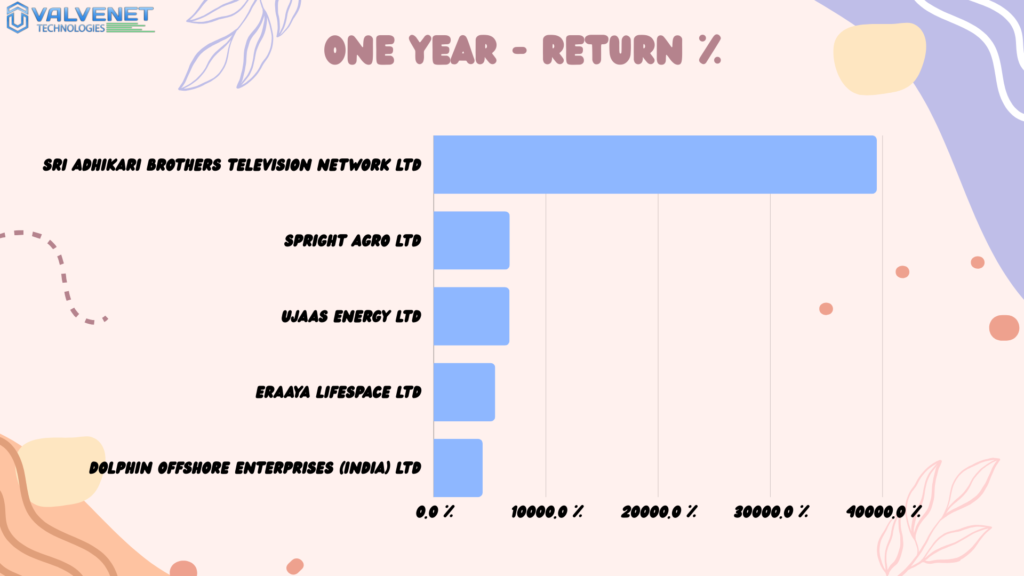

Here’s a look at the top 10 highest-return stocks in India over the past year, ranked by their impressive one-year returns:

| S.No | Company Name | One-year Return % |

|---|---|---|

| 1 | Sri Adhikari Brothers Television Network Ltd | 39488.89 % |

| 2 | Spright Agro Ltd | 6773.40 % |

| 3 | Ujaas Energy Ltd | 6756.94 % |

| 4 | Eraaya Lifespace Ltd | 5479.75 % |

| 5 | Dolphin offshore Enterprises (India) Ltd | 4362.17 % |

| 6 | Kesar India Ltd | 2381.27 % |

| 7 | Technvision Ventures Ltd | 2112.28 % |

| 8 | Marsons Ltd | 1704.65 % |

| 9 | Tinna Trade Ltd | 1399.25 % |

| 10 | KKRAFTON Developers Ltd | 1375.08 % |

Stock Performance Highlights

Top Performing Stocks: Profit Highlights and Investor Insights

- Sri Adhikari Brothers Television Network Ltd.

- Profit Increase: 100.95%

- Investor Impact: This impressive profit leap has likely generated significant investor interest.

- Spright Agro Ltd.

- Profit Increase: 3,806.25%

- Return on Capital Employed (ROCE): 38.62%

- Investor Impact: With such a massive profit boost and efficient capital use, Spright Agro has clearly caught investors’ attention.

- Ujaas Energy Ltd.

- Profit Increase: 165.19%

- Investor Impact: The rise in profits, driven by the growing popularity of renewable energy, has likely excited the market.

- Eraaya Lifespace Ltd.

- Profit Increase: 1,800%

- Return on Equity (ROE): 5.36%

- Investor Impact: Despite a low ROE, the dramatic profit increase has attracted investor interest.

- Dolphin Offshore Enterprises (India) Ltd.

- Profit Increase: 948.31%

- Return on Capital Employed (ROCE): Negative

- Investor Impact: High profit growth, even with a negative ROCE, has likely drawn attention due to its strong financial performance.

- Kesar India Ltd.

- Return on Capital Employed (ROCE): 39.29%

- Return on Equity (ROE): 41.60%

- Investor Impact: Solid financial health and efficient resource use have likely made Kesar India a favorite among investors

- Technvision Ventures Ltd.

- Profit Increase: 131.58%

- Return on Capital Employed (ROCE): 98.14%

- Return on Equity (ROE): 324.07%

- Investor Impact: Exceptional returns and high efficiency in capital use have impressed investors.

- Marsons Ltd.

- Profit Increase: 1,318.60%

- Return on Capital Employed (ROCE): 3.09%

- Investor Impact: The significant profit increase, despite a modest ROCE, has likely boosted its stock appeal

- Tinna Trade Ltd.

- Debt-to-Equity Ratio: 0.96

- Investor Impact: A balanced financial structure with a low debt-to-equity ratio may have attracted investors.

KKRAFTON Developers Ltd.

- ROCE: 8.55%

- ROE: 6.56%

- Investors Impact: The stock shows high price fluctuations and a high P/E ratio with no dividend yield, indicating potential volatility and investor caution.

Many of these companies fall within a market value range of ₹1,300 crores to ₹4,950 crores. Smaller companies often exhibit rapid growth potential but may also experience higher volatility.

The price-to-earnings (P/E) ratios of these stocks vary significantly. For instance, Spright Agro Ltd has a notably high P/E ratio of 216.54, reflecting optimistic expectations for future growth. On the other hand, Ujaas Energy Ltd has a more moderate P/E ratio of 102.77.

These variations highlight that stock evaluation extends beyond mere profit growth. It’s crucial to consider factors like profitability, operational efficiency, financial health, and market expectations in a comprehensive analysis.

Investment Strategies for High-Return Stocks

Investing in high-return stocks can be thrilling but requires a smart approach:

Do Your Research: Understand the company’s business model, advantages, and growth potential before investing.

Diversify Your Portfolio: Spread your investments across different stocks and sectors to reduce risk.

Keep an Eye on Your Investments: High-return stocks can be volatile, so monitor them closely and be ready to make quick decisions if necessary.

Set Realistic Goals: Past performance doesn’t guarantee future results. Be cautious and avoid expecting the same high returns indefinitely.

Understand Your Risk Tolerance: High-return stocks can be risky. Make sure you’re comfortable with the potential ups and downs.

Risks of High-Return Stocks

High-return stocks can be exciting, but they come with risks:

- Volatility: Their prices can change rapidly based on news or company performance.

- Overvaluation: Stocks that have risen quickly might become overpriced, leading to possible price drops.

- Lack of Diversification: Investing too much in a few high-return stocks can be risky if those stocks don’t perform well.

- Market Timing Risk: It’s hard to predict the best times to buy or sell. Poor timing can lead to losses.

- Company-Specific Risks: Smaller or newer companies might struggle to maintain their growth or profits.

Conclusion

Investing in high-return stocks can potentially boost your portfolio, but it’s important to research thoroughly, diversify your investments, and understand your risk tolerance. These stocks should be part of a balanced investment strategy.

Remember the golden rule: only invest money you can afford to lose. With careful planning, high-return stocks can be an exciting and valuable part of your investment journey.