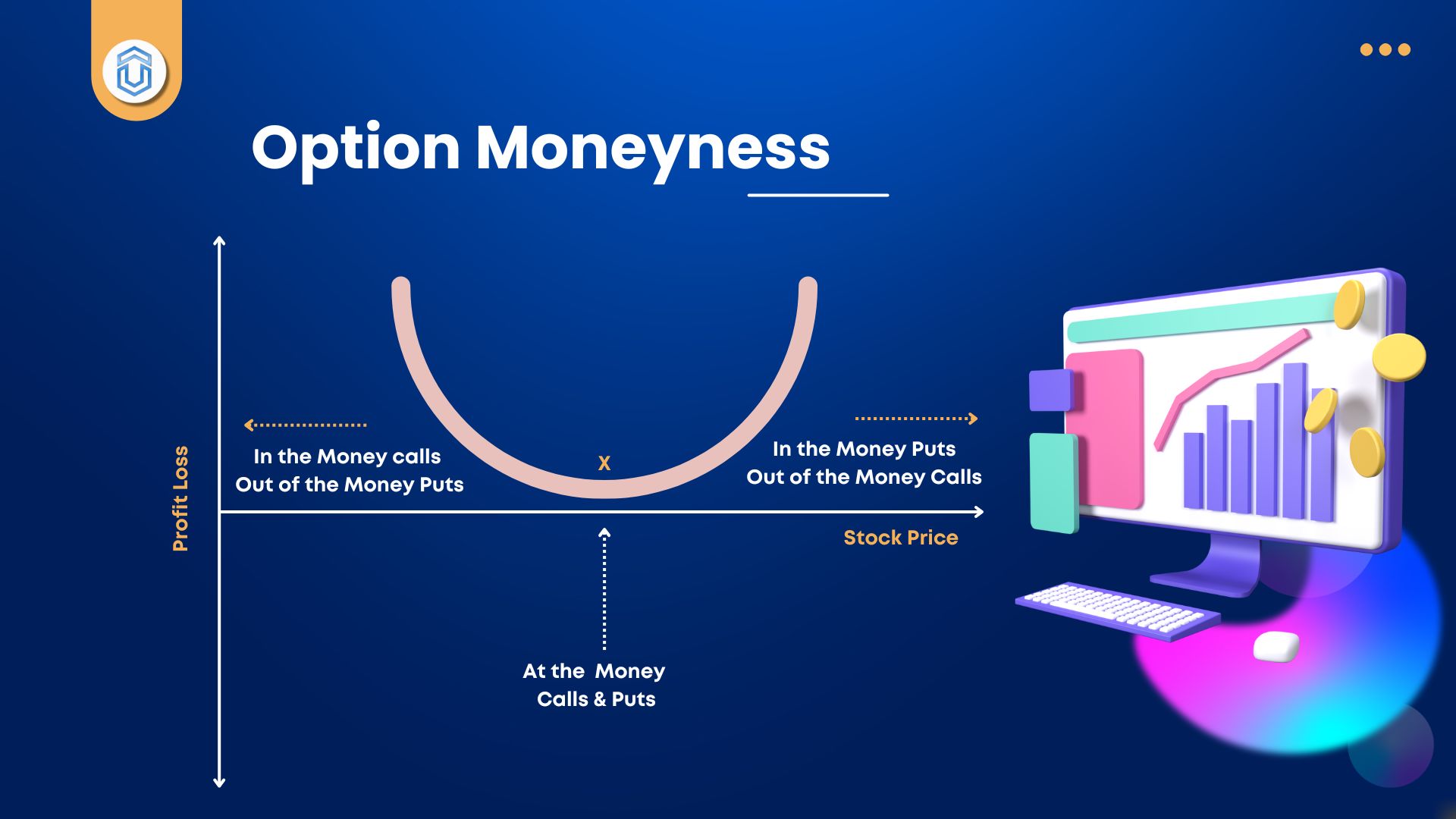

The foundational concept that every trader should understand in options trading is “Moneyness.” Each options contract is influenced by the movements of the underlying stock. The relationship between the underlying price and the option’s premium indicates its moneyness.

Moneyness is classified into three categories: In-the-Money (ITM), At-the-Money (ATM), and Out-of-the-Money (OTM).

Whether you’re just starting out or looking to sharpen your skills, this guide will break down ITM, ATM, and OTM in simple terms, in both the call options and put options perspective. This guide helps you grasp their significance and how they impact your trading strategy.

Let’s dive in!

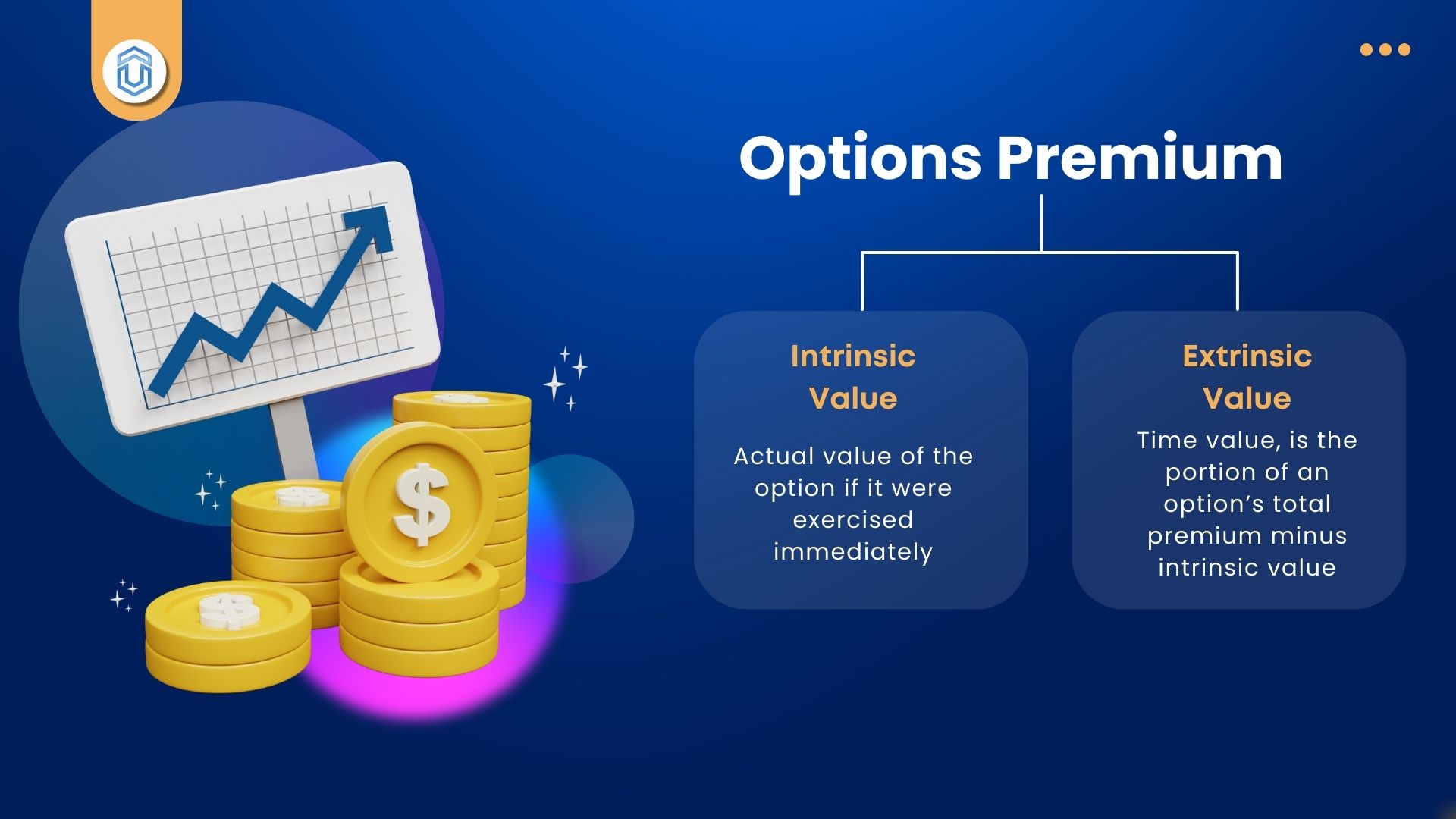

What is Options Premium?

Before entering into Options Moneyness, we need to the know more about the Options premium price. The Options premium is the price that a buyer pays to purchase an options contract. It represents the cost of acquiring the right, but not the obligation to buy or sell the underlying asset at a predetermined price (the strike price) before a specified expiry date.

The Options Premium has two major components:

Intrinsic Value:

This is the actual value of the option if it were exercised immediately. It measures how much an option is “in the money” and is calculated based on the difference between the underlying asset’s current price and the option’s strike price.

For call option

Intrinsic value = Current price of the underlying asset- Strike Price

For example, if the current price of the stock is 24,100 and the strike price of the call option is 24,000, the intrinsic value of the call option is ₹ 100 (24100 – 24000).

For put option

Intrinsic value = Strike price – Current price of the underlying asset.

For example, if the current price of the stock is 24,100 and the strike price of the put option is 24,200, the intrinsic value of the put option is ₹ 100 (24200 – 24100).

Extrinsic value:

Extrinsic value, also known as time value, is the portion of an option’s total premium that is attributed to factors other than the intrinsic value. It represents the additional amount an investor is willing to pay for the potential of future profitability.

Extrinsic value = Option Premium – Intrinsic Value

In general, Option premium is the sum of intrinsic and extrinsic values. Depending on these values, options are categorized into three types: In-the-money, Out-of-the-money, and At-the-money.”

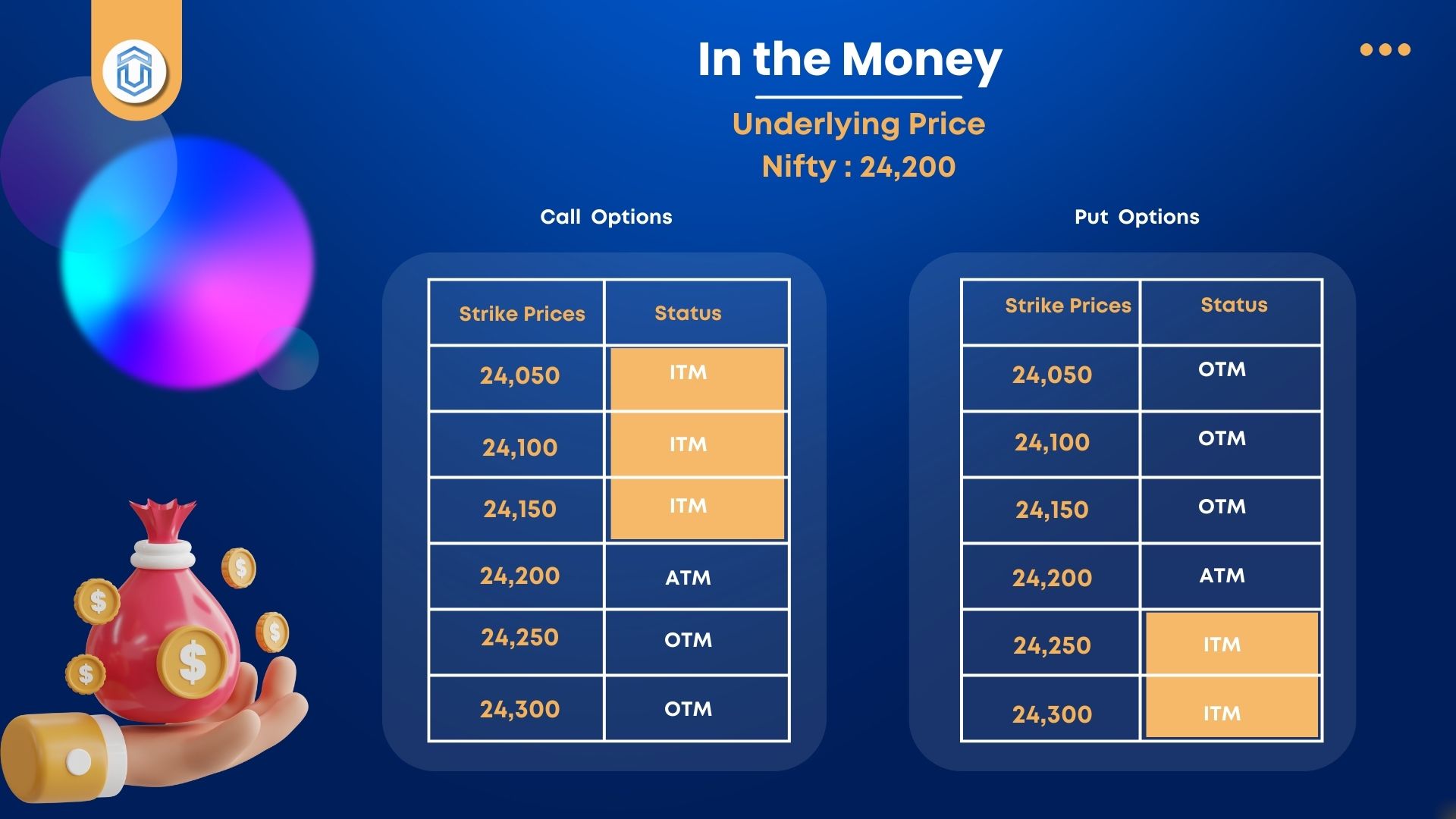

1. In-the-Money (ITM) Options:

In the money (ITM) is a term used in options trading to describe a situation where an option has intrinsic value. Here’s how it applies to call and put options:

For Call Options:

A call option is considered “in the money” when the current price of the underlying asset is above the option’s strike price.

Underlying price > Strike Price

For example, look at the above Nifty option chain. The underlying value of Nifty is 24,200. In the Nifty strike prices, the price less than 24,200 are all considered In-the-money for call options. For example, 24,150, 24100, 24050, 24000…….

For Put Options:

A put option is “in the money” when the current price of the underlying asset is below the option’s strike price.

Underlying price < Strike Price

For example, look at the above Nifty option chain. The underlying value of Nifty is 24,200. In the Nifty strike prices, the price above 24,200 are all considered In-the-money for put options. For example, 24250, 24300, 24350…..

Implications:

ITM options typically have higher premiums because they offer immediate intrinsic value. It has both Intrinsic and Extrinsic values. Option premium increases while we go deep in the money options.

They are often preferred by traders who want to secure a position in the underlying asset with a lower risk of expiring worthless.

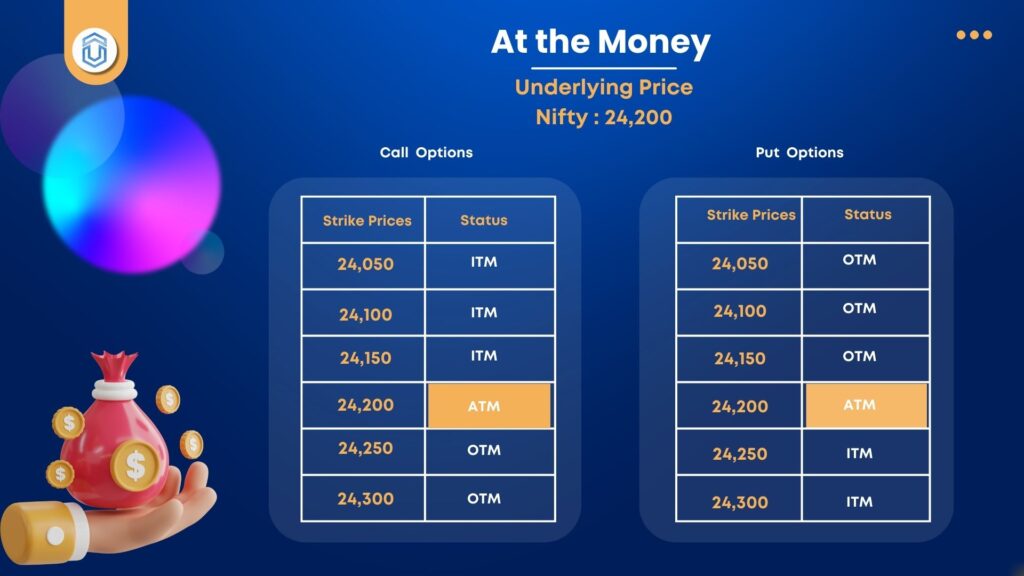

2. At-the-Money (ATM) Options:

At-The-Money or ATM defines a situation wherein the strike price of a put or a call option is equivalent or close to the current market price of an underlying asset.

Underlying price = Strike Price

(Note: It’s just an assumption. Strike price nearest to underlying can be taken as ATM, since the underlying price is always variable).

For example, look at the above Nifty option chain. The underlying value of Nifty is ₹ 24,200. In the Nifty strike prices, the price close to 24,200 is considered as At-the-money options.

For both call and put options, at-the-money strike prices are same. At the money contracts are traded often as it reflects the underlying value. At the money has no intrinsic value in it. It has only extrinsic and implied volatility values.

ATM contracts premium are less compared to In-the-money and more compared to out-of-the-money contracts.

Implications:

ATM options generally have the highest time value and can be the most volatile, as even small price movements in the underlying asset can result in significant changes in option value.

Traders often use ATM options for Options strategies that rely on high volatility or for hedging purposes.

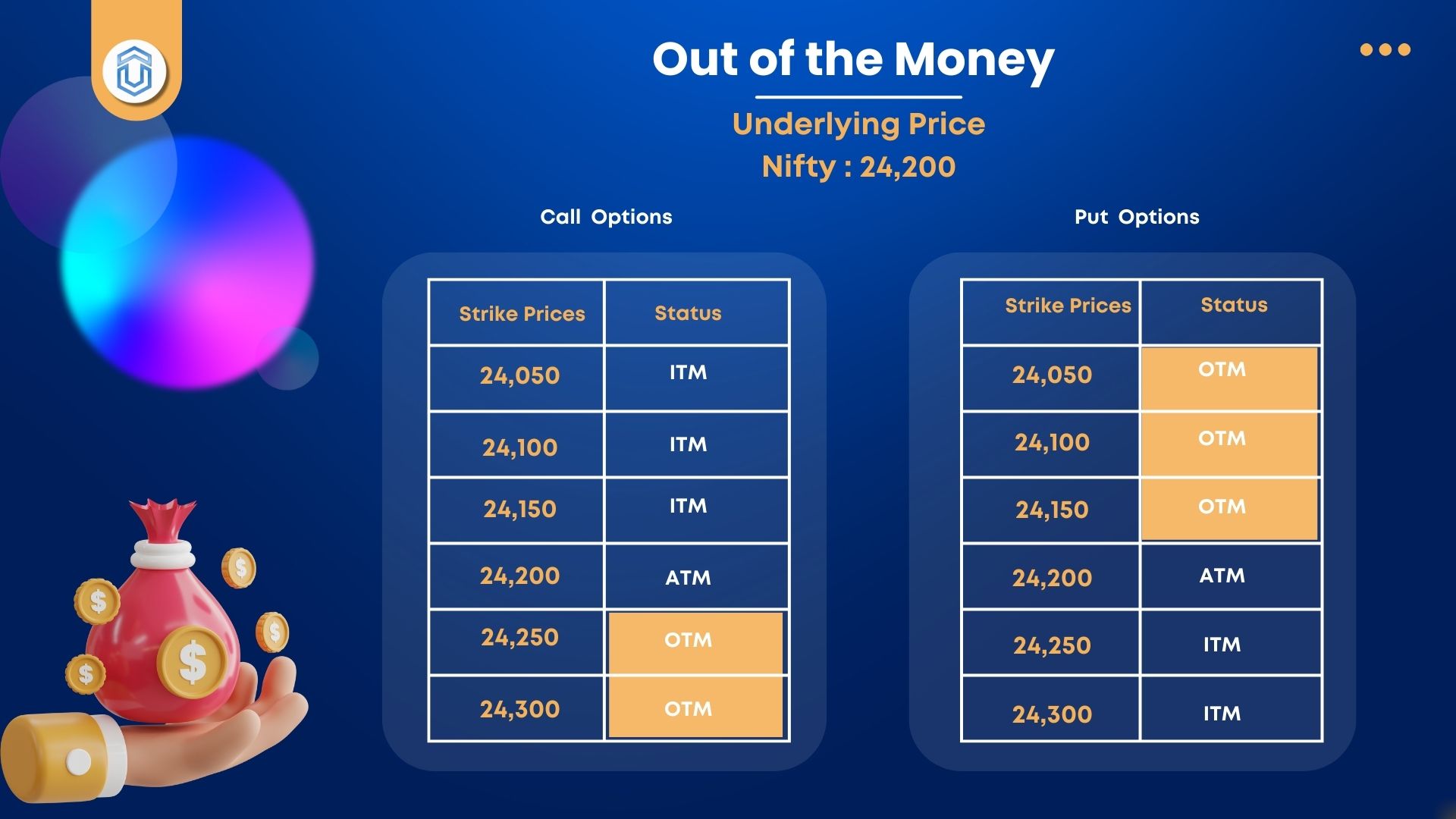

3. Out-of-the-Money Options:

Out-of-the money (OTM) is a term used in options trading to describe a situation where an option has no intrinsic value. Here’s how it applies to call and put options:

For Call Options:

A call option is considered “out of the money” when the current price of the underlying asset is below the option’s strike price.

Underlying price < Strike Price

For example, look at the above Nifty option chain. The underlying value of Nifty is 24,200. In the Nifty strike prices, the prices above 24,200 are all considered Out-of-the-money for call options. For example, 24250, 24300, 24350…..

For Put Options:

A put option is “out of the money” when the current price of the underlying asset is above the option’s strike price.

Underlying price > Strike Price

For example, look at the above Nifty option chain. The underlying value of Nifty is 24,200. In the Nifty strike prices, the price below 24,200 are all considered out-of-the-money for put options. For example, 24150, 24100, 24050…..

OTM options have no intrinsic value, but they may still have time value and potentially some extrinsic value based on factors like the time remaining until expiration and the volatility of the underlying asset.

Implications:

OTM options have lower premiums since they are less likely to expire in-the-money. They can be attractive for speculative trading, as they offer a chance for significant returns if the underlying asset moves favorably.

Moneyness and Trading Strategies:

Understanding the distinctions between ITM, ATM, and OTM options is crucial for developing effective trading strategies. Here are some considerations:

- Risk and Reward: ITM options generally offer more certainty but at a higher cost, while OTM options are cheaper but carry more risk. Traders should weigh their risk tolerance against potential rewards.

- Market Sentiment: ATM options are often seen as indicators of market sentiment. High volume in ATM options can suggest that traders expect significant movement in the underlying asset.

- Time Decay: OTM options are more susceptible to time decay, meaning their value decreases more rapidly as expiration approaches. Traders need to be mindful of this when holding OTM positions.

- Hedging: ITM options can serve as effective hedges in uncertain markets, while ATM options might be used to capitalize on anticipated volatility.

Conclusion:

Understanding options moneyness—ITM, OTM, and ATM—is essential for any trader looking to navigate the options market effectively. By grasping how these concepts affect pricing, risk, and strategy, traders can make more informed decisions that align with their investment goals.

Whether you’re looking to hedge against market movements or speculate on price changes, a solid foundation in moneyness will empower you to navigate the complexities of options trading with confidence.