In the previous article we have seen about the Call Options guide. Here we will see about the Put Options in detail.

Options Trading has become one of the most attractive trading instruments in market. Because of its wide variety of trading options with High leverage, options gained a wider audience in a shorter period of time.

Options can generally be categorized into two main types: Call Options and Put Options.

Traders can take positions with a minimum amount of the entire transaction value, known as the Premium. With low capital requirements, traders can achieve high profits. Profitability in options trading depends on factors such as the movement of the underlying asset, the strike price, and market volatility.

Exploring the intricacies of options trading, this article delves into the specifics of Put options. Let’s dive right in!

1. What is Put Options? Understanding the basics

- A put option gives the holder (buyer) the right, but not the obligation, to sell an underlying asset at a specified price (strike price) within a predetermined period (until expiration). Put options are typically purchased when the investor expects the price of the underlying asset to fall.

- The seller of a put option the seller (writer) has the obligation to buy the specified quantity of the underlying asset at the strike price if the buyer decides to exercise the option.

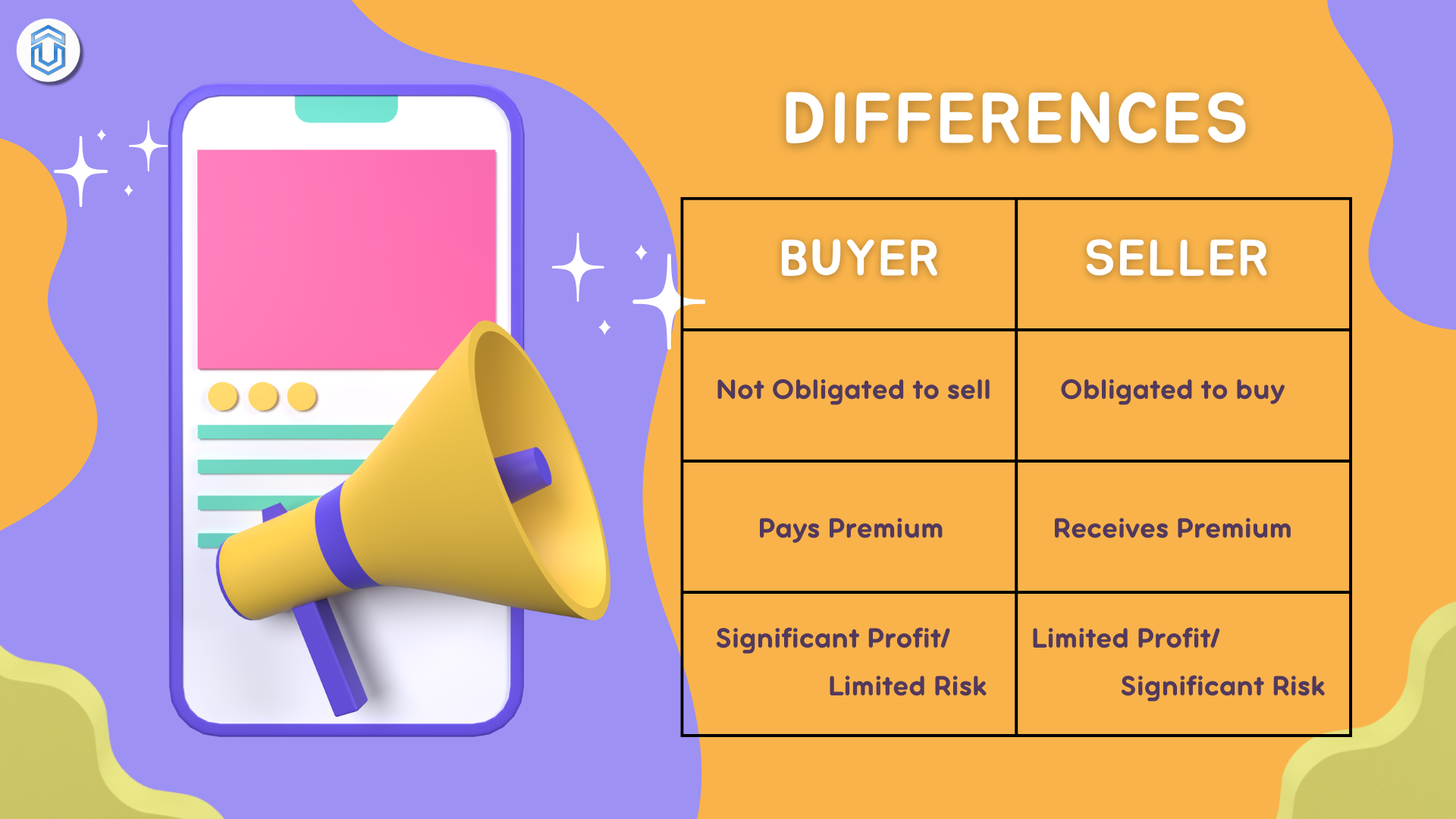

From the above definitions, we can conclude that a put option contract has two participants:

Options Buyer (Holder): The individual who purchases the put option and has the right to sell the underlying asset at the strike price.

Options Seller (Writer): The individual who sells the put option and has the obligation to buy the underlying asset at the strike price if the buyer exercises the option.

Look at the chart below of the key points about both Put Option buyer and seller.

| Features | Put Option Buyer Holder | Put Option Seller Writer |

|---|---|---|

| Rights | The buyer of a put option has the right to sell, but not the obligation to sell | The seller of a put option (writer) has the obligation to buy, if the buyer decides to exercise the option. |

| Views | Buyers typically expect the price of the underlying asset to fall (bearish outlook) | Sellers may expect the price to remain stable or even increase (neutral to bullish outlook) |

| Premium | The buyer pays a premium to the seller (writer) of the put option. This premium is the price of the option and compensates the seller for taking on the obligation to buy the asset if the buyer decides to exercise the option. | In exchange for taking on the obligation, the seller receives a premium from the buyer upfront. This premium is the seller's compensation for undertaking the potential obligation to buy the asset. |

| Profit | The put option buyer has a high profit potential if the asset's price drops significantly. If the put option falls below the strike price plus the premium, buyer sees a profit profile. | The maximum profit for the seller of a put option is the premium received. This occurs if the option expires worthless (i.e., the underlying asset price exceed the strike price by expiration). |

| Risk | Risk is limited to the premium paid | The maximum loss for a put option seller occurs if the underlying asset's price falls to zero. In this case, the seller is obligated to buy the asset at the strike price, even though it is now worth nothing in the market. Therefore, the loss is capped by the strike price minus any premium received. |

2. Understanding Put Options with an example

Put Option Buyer

Let us assume that the stock of a company Z, currently trading at ₹ 100 per share.

Current Stock Price : ₹ 100 per share

Trader Sam’s Prediction : Sam believes that the stock price of company Z might fall significantly in the next 3 months.

Sam’s Put Option Purchase Details :

- Strike Price : ₹ 130

- Expiry : 3 months from now

- Premium : ₹ 10 per share

- Contract Size : 100 shares

- Total Premium Paid : ₹ 10 * 100 = ₹ 1000

Understanding the Put Option :

- Right to Sell : By purchasing the put option, Sam has the right to sell 100 shares of company Z at ₹ 130 per share before the option expires, regardless of the market price.

- Obligation of the Seller : The seller of the put option is obligated to buy the shares at ₹130 if Sam decides to exercise the option.

Profit Calculation for Put Option Buyer :

Scenario 1 : Stock Price Falls Below the Strike Price

Assume that the stock price of company Z falls to ₹ 80 per share before expiry. Sam decides to exercise the put option.

Profit Calculation :

- Sell Price (Strike Price) : ₹ 130 per share

- Buy Price (Market Price) : ₹ 80 per share

- Premium Paid : ₹ 10 per share

Profit per Share :

Profit = Strike Price − Market Price − Premium Paid

₹ 130 − ₹ 80 − ₹ 10 = ₹ 40 per share

Total Profit :

Total Profit = ₹ 40 × 100 = ₹ 4000

Profit Potential : The profit is significant if the stock price falls well below the strike price, but it is not unlimited. The maximum profit is capped when the stock price falls to zero.

Loss Calculation for Put Option Buyer:

Scenario 2 : Stock Price Remains Above the Strike Price

Assume that the stock price of company Z rises to ₹ 120 per share before expiry. Sam decides not to exercise the option because the stock price is higher than the strike price.

Loss Calculation:

Premium Paid : ₹ 10 per share

Loss = Premium Paid

Loss = ₹ 10 × 100 = ₹ 1000

Loss Potential : The loss is limited to the premium paid for the option.

Analogies for Understanding:

Profit Scenario : Think of it like this! If you have a contract to sell rice at ₹ 130 per kg, and the market price falls to ₹ 80 per kg, you can still sell it at ₹ 130 per kg. Your profit is the difference between the contract price and the market price, minus the cost of making the contract.

Loss Scenario : If the market price of rice is ₹120 per kg and you have a contract to sell it at ₹ 130 per kg, it doesn’t make sense to sell at the contract price. You’d only lose the cost of making the contract (the premium), similar to how you would only lose the premium paid for the put option.

In summary, a put option buyer profits when the stock price falls below the strike price minus the premium paid, with potential losses limited to the premium paid.

Put Option Seller

Here we see about the Put Option Seller profile. Let us assume that the stock of a company Z, currently trading at ₹ 100 per share.

Current Stock Price : ₹ 100 per share

Trader Ram’s Prediction : Ram believes that the stock price of company Z will either remain stable or increase. Thus, he decides to sell a put option on that stock.

Ram’s Put Option Sale Details :

- Strike Price : ₹ 130

- Expiry : 3 months from now

- Premium Received : ₹ 10 per share

- Contract Size : 100 shares

- Total Premium Received : ₹ 10 * 100 = ₹ 1000

Understanding the Put Option :

- Obligation of the Seller : By selling the put option, Ram is obligated to buy 100 shares of company Z at ₹ 130 per share if the buyer (Sam) decides to exercise the option before expiry.

- Profit from Time Decay and Volatility : The seller benefits from the passage of time (theta decay) and decreases in volatility (vega), as these factors can make the option less valuable over time.

Profit Calculation for Put Option Seller :

Scenario 1 : Stock Price Remains Above the Strike Price

Assume that before expiry, the stock price of company Z rises to ₹ 120 per share. The put option buyer (Sam) will not exercise the option since the market price is above the strike price.

Profit Calculation :

Premium Received : ₹ 10 per share

Profit :

Profit = Premium Received

Profit = ₹ 10 × 100 = ₹ 1000

In this case, Ram retains the entire premium as profit because the option is not exercised.

Loss Calculation for Put Option Seller :

Scenario 2 : Stock Price Falls Below the Strike Price

Assume that the stock price of company Z falls to ₹ 80 per share before expiry. The put option buyer (Sam) will exercise the option, and Ram is obligated to buy the stock at ₹ 130 per share.

Loss Calculation :

- Sell Price (Strike Price) : ₹ 130 per share

- Buy Price (Market Price) : ₹ 80 per share

- Premium Received : ₹ 10 per share

Loss per Share :

Loss = Strike Price − Market Price −Premium Received

Loss = ₹ 130 − ₹ 80 − ₹ 10 = ₹ 40 per share

Total Loss :

Total Loss = ₹ 40 × 100 = ₹ 4000

Summary

Profit for Put Option Seller : The profit is limited to the premium received if the stock price remains above the strike price. In the example, Ram’s profit would be ₹ 1000 if the stock price remains above ₹ 130.

Loss for Put Option Seller : The potential loss can be substantial if the stock price falls significantly below the strike price. The loss is calculated as the difference between the strike price and the market price, minus the premium received. If the stock price falls to ₹80, the loss would be ₹ 4000.

Risk Profile : While the potential loss for a put option seller is significant, it is not unlimited. The loss is limited to the strike price minus the premium received, but it can be substantial if the underlying stock price falls dramatically.

Understanding Payoff Graph for Put Options

Understanding the payoff graph of put options is essential for traders to visualize potential profits and losses based on different scenarios involving the underlying asset’s price at expiration.

Here’s a detailed explanation of the payoff graph for put options :

While plotting Payoff graph, remember that there are three key variables to consider. Strike price, Expiration date, and Premium. We will plot the payoff graph from our previous example Sam and Ram.

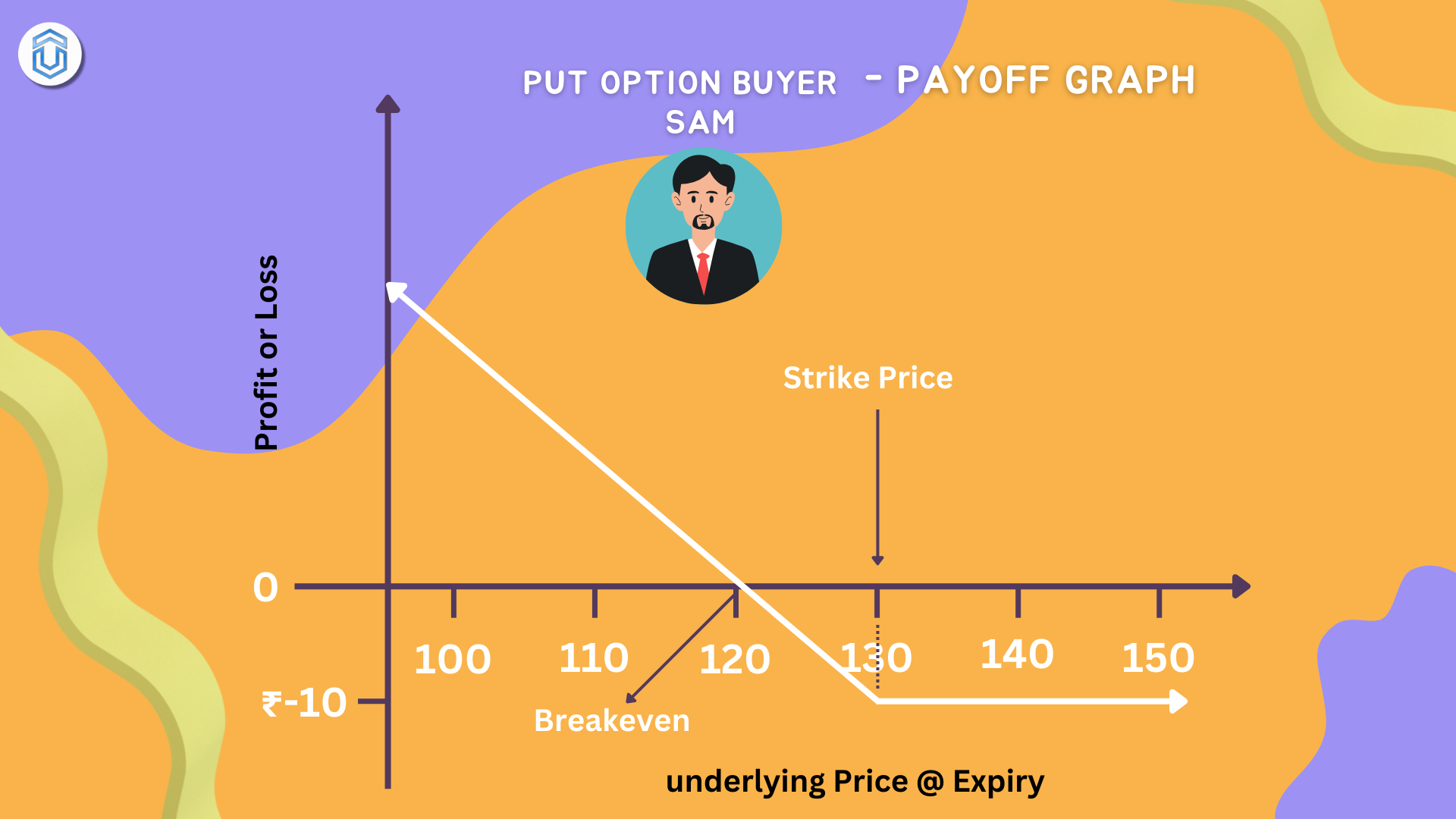

Put Option Buyer Payoff Graph

Key Variables in the Example :

- Strike Price (K) : ₹ 130

- Premium Paid/Received (P) : ₹ 10 per share

- Underlying Asset Price (S): Varies from below to above the strike price.

Put Option Buyer’s Payoff Graph :

Payoff Calculation for the Buyer :

Payoff = max (K − S,0) − P

Where:

- K = ₹ 130 (Strike Price)

- S = Underlying Asset Price at Expiration

- P = ₹ 10 (Premium Paid)

Graph Explanation:

- If the underlying increases (S ≥ K) The put option expires worthless. The payoff is −P, which is − ₹ 10 (the premium paid).

- If the underlying decreases (S < K), the payoff increases linearly as the asset price decreases below the strike price. The payoff is K−S− P

Example Calculation:

- If S = ₹ 130

- Payoff = − ₹ 10

- If S = ₹ 120

- Payoff = ₹ 130 − ₹ 120 − ₹ 10 = ₹ 0

- If S = ₹ 100

- Payoff = ₹ 130 − ₹ 100 − ₹ 10 = ₹ 20

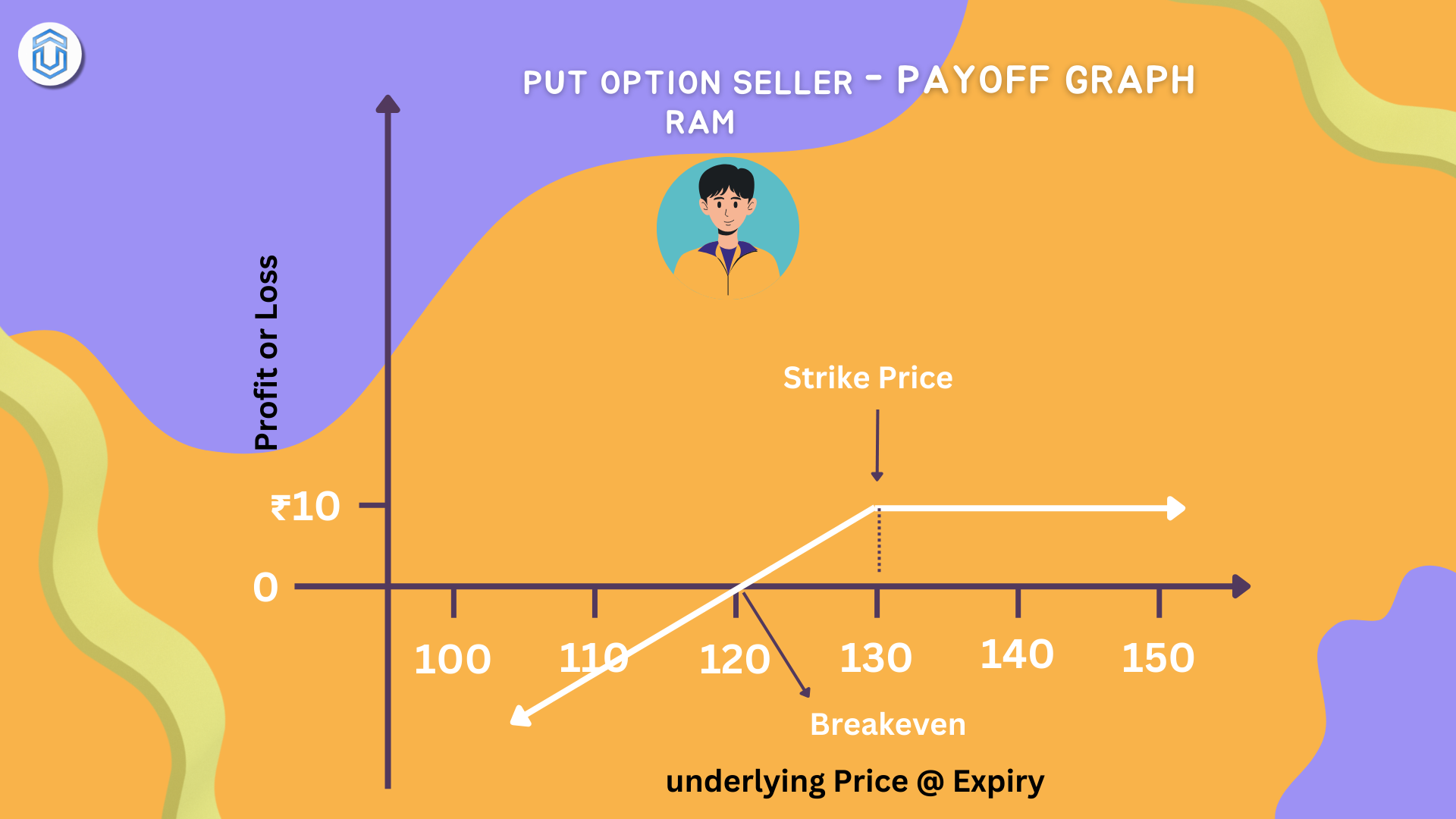

Put Option Seller Payoff Graph

Payoff Calculation for the Seller :

Payoff = − max (K − S, 0) + P

Where:

- K = ₹ 130 (Strike Price)

- S = Underlying Asset Price at Expiration

- P = ₹ 10 (Premium Received)

Graph Explanation:

- If S ≥ KS, the put option expires worthless. The payoff is P, which is ₹ 10 (the premium received).

- If S<K, the payoff decreases linearly as the asset price falls below the strike price. The payoff is P − (K−S)

Example Calculation:

- If S = ₹ 130

- Payoff = ₹ 10

- If S = ₹ 120

- Payoff = ₹ 10−(₹ 130 − ₹ 120) = ₹0

- If S = ₹ 100

- Payoff = ₹ 10 − (₹ 130 − ₹ 100) = −₹ 20

Difference between Long and Short Put option

The terms “long put option” and “short put option” refer to different strategies in options trading. Each has distinct characteristics, uses, and risk profiles. Here’s a detailed comparison:

Long Put Option

Definition:

- Long Put Option : This involves buying a put option. The buyer has the right, but not the obligation, to sell the underlying asset at the strike price before or at expiration.

Objectives :

- Speculation: To profit from a decline in the price of the underlying asset.

- Hedging : To protect against potential losses in a portfolio if the underlying asset’s price falls.

Profit and Loss Profile :

- Profit Potential : The profit is theoretically unlimited as the asset price can fall significantly. The maximum profit occurs when the underlying asset price approaches zero.

- Loss Potential : Limited to the premium paid for the put option. This is the maximum loss if the option expires worthless (i.e., the asset price is above the strike price at expiration).

Short Put Option

Definition :

- Short Put Option : This involves selling a put option. The seller (or writer) has the obligation to buy the underlying asset at the strike price if the buyer of the put option decides to exercise it.

Objectives :

- Income Generation : To collect the premium from selling the put option, typically when the seller expects the asset price to remain above the strike price.

- Speculation : To profit if the asset price stays above the strike price or increases.

Profit and Loss Profile :

- Profit Potential : Limited to the premium received for selling the put option. This is the maximum profit if the option expires worthless (i.e., the asset price remains above the strike price at expiration).

- Loss Potential : Potentially substantial and theoretically unlimited if the underlying asset’s price falls significantly below the strike price. The loss increases as the asset price decreases below the strike price.

Conclusion

Put options are a pivotal component of modern financial markets, offering strategic opportunities for both risk management and speculative investments. This guide has provided a thorough understanding of put options, including their definitions, types, applications, and risk profiles.

By understanding the mechanics, payoff profiles, and strategic applications of put options, traders and investors can make informed decisions and employ these instruments effectively in their investment strategies.

Always consider your risk tolerance and market outlook when engaging with put options to align with your financial goals and risk management practices.

Have a Good day!